Blackberry 2003 Annual Report Download - page 12

Download and view the complete annual report

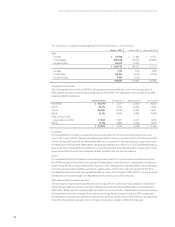

Please find page 12 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

10

Inventory

Rawmaterialsarestatedatthelowerofcostandreplacementcost.Workinprocessandnishedgoods

inventoriesarestatedatthelowerofcostandnetrealizablevalue.Costincludesthecostofmaterials

plusdirectlabourappliedtotheproductandtheapplicableshareofmanufacturingoverhead.Costis

determinedonarst-in-rst-outbasis.

TheCompany’spolicyforthevaluationofinventory,includingthedeterminationofobsoleteorexcess

inventory,requiresmanagementtoestimatethefuturedemandfortheCompany’sproductswithin

specictimehorizons.Inventorypurchasesandpurchasecommitmentsarebaseduponsuchforecasts

offuturedemandandscheduledroll-outofnewproduct.ThebusinessenvironmentinwhichRIMoperates

issubjecttorapidchangesintechnologyandcustomerdemand.TheCompanyperformsadetailed

assessmentofinventoryeachreportingperiod,whichincludesareviewof,amongotherfactors,demand

requirements,componentpartpurchasecommitments,productlifecycleanddevelopmentplans,

componentcosttrends,productpricingandqualityissues.Ifcustomerdemandsubsequentlydiffersfrom

theCompany’sforecasts,requirementsforinventorywrite-offscoulddifferfromtheCompany’sestimates.

IfmanagementbelievesthatdemandnolongerallowstheCompanytosellinventoriesabovethatcost

oratall,suchinventoryiswrittendowntonetrealizablevalueorexcessinventoryiswrittenoff.

Valuationoflong-livedassets,intangibleassetsandgoodwill

Inconnectionwiththebusinessacquisitionscompletedinscal2002and2003,theCompanyidentied

andestimatedthefairvalueofassetsacquiredincludingcertainidentiableintangibleassetsotherthan

goodwillandliabilitiesassumedinthecombinations.Anyexcessofthepurchasepriceovertheestimated

fairvalueoftheidentiednetassetswasassignedtogoodwill.Thedeterminationofestimatedlivesfor

long-livedandintangibleassetsinvolvessignicantjudgement.

TheCompanyassessestheimpairmentofidentiableintangibles,long-livedassetsandgoodwill

whenevereventsorchangesincircumstancesindicatethatthecarryingvaluemaynotberecoverable.

Unforeseeneventsandchangesincircumstancesandmarketconditionsandmaterialdifferencesinthe

valueoflong-livedandintangibleassetsandgoodwillduetochangesinestimatesoffuturecashows

couldaffectthefairvalueoftheCompany’sassetsandrequireanimpairmentcharge.

EffectiveMarch3,2002,theCompanyadoptedthenewrecommendationsofSection3063ofthe

CanadianInstituteofCharteredAccountants(“CICA”)Handbook(“CICA3063”)withregardstotheimpair-

mentoflong-livedassetsandaccordingly,long-livedassetsaretestedforrecoverabilitywheneventsor

changesincircumstancesindicatethattheircarryingamountmaynotberecoverable.Ifsuchanevent

occurs,theaffectedassetiswrittendowntoitsfairvalue.Therewasnoimpacttoretainedearningsasa

resultoftheadoptionofthisrecommendation.

EffectiveMarch3,2002,theCompanyadoptedthenewrecommendationsofSection3062oftheCICA

Handbook(“CICA3062”)withregardstogoodwillandintangibleassetsandaccordingly,goodwillis

nolongeramortizedtoearnings,butperiodicallytestedforimpairment.Uponadoptionofthesenew

recommendations,goodwillwasrequiredtobetestedforimpairment.TheCompanyperformedthe

requiredimpairmenttestsofgoodwillasatMarch1,2003andMarch3,2002andconcludedthatthe

existinggoodwillwasnotimpaired.TheCompanydidnothaveanygoodwillpriortotheadoptionof

thenewrecommendation,therefore,therewasnoimpacttoprioryear’searningsuponitsadoption.

Incometaxes

TheCompany’sfuturetaxassetbalancerepresentstemporarydifferencesbetweenthenancial

reportingandtaxbasesofassetsandliabilitiesincludingresearchanddevelopmentcostsandincentives,

nancingcosts,capitalassets,non-deductiblereserves,aswellasoperatinglosscarryforwardsandcapital

losscarryforwards,netofvaluationallowances.TheCompanyevaluatesitsfuturetaxassetsbasedupon

estimatesofprojectedfuturetaxableincomestreamsduringperiodsinwhichtemporarydifferences

becomedeductibleandtaxplanningstrategies.TheCompanyrecordsavaluationallowancetoreduce

futureincometaxassetstotheamountthatismorelikelythannottoberealized.Asaresultofthe

currentoperatinglossesincurred,aswellasforecastedneartermoperatinglosses,theCompanyhas