Blackberry 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

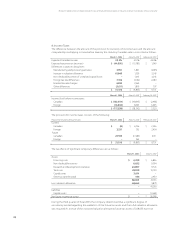

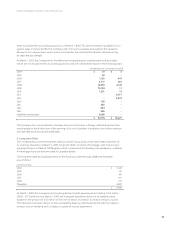

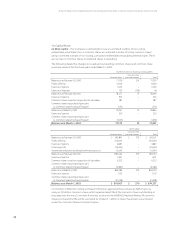

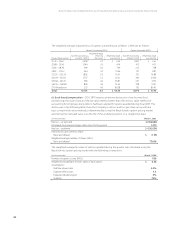

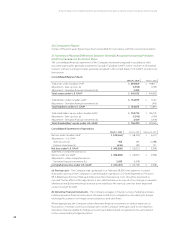

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

47

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

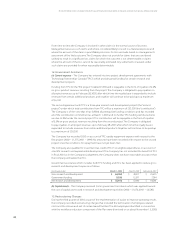

18.FinancialInstruments

TheCompanyisexposedtoforeignexchangeriskasaresultoftransactionsincurrenciesotherthanits

functionalcurrencyofU.S.dollars.ThemajorityoftheCompany’srevenuesinscal2003aretransacted

inU.S.dollars,EuroandBritishpounds.PurchasesofrawmaterialsareprimarilytransactedinU.S.dollars.

Otherexpenses,consistingofthemajorityofsalaries,certainoperatingcostsandallmanufacturing

overhead,areincurredprimarilyinCanadiandollars.AtMarch1,2003,approximately14%ofcashand

cashequivalents,13%oftradereceivablesand8%ofaccountspayableandaccruedliabilitiesare

denominatedinforeigncurrencies(2002–nil%,24%,and25%,respectively).Theseforeigncurrencies

includetheCanadianDollar,BritishPound,Euro,Australiandollar,HongKongdollar,andJapaneseYen.

Tomitigatetherisksrelatingtoforeignexchangeuctuations,theCompanymaintainsnetmonetary

assetand/orliabilitybalancesinforeigncurrenciesandengagesinforeigncurrencyhedgingactivities

throughtheutilizationofderivativenancialinstruments.TheCompanydoesnotpurchaseorholdany

derivativeinstrumentsforspeculativepurposes.

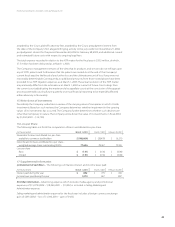

Tohedgeexposuresrelatingtoforeigncurrencyanticipatedtransactions,theCompanyhas

enteredintoforwardforeignexchangecontractstosellU.S.dollarsandpurchaseCanadiandollars

withanaggregatenotionalvalueofU.S.$58.1millionasatMarch1,2003(2002–$87.5million,2001–

$44.5million).ThesecontractscarryaweightedaveragerateofU.S.$1.00equalsCanadian$1.5831,

andmatureatvariousdates,withthelatestbeingDecember1,2003.Thesecontractshavebeen

designatedascashowhedges,withgainsandlossesonthehedgeinstrumentsbeingrecognized

inthesameperiodas,andaspartof,thehedgedtransaction.AsatMarch1,2003,thenotionalgain

ontheseforwardcontractswasapproximately$3,439(2002–notionallossof$1,478,2001–$nil).

Tohedgeexposurerelatingtoforeigncurrencydenominatedlong-termdebt,theCompanyhas

enteredintoforwardforeignexchangecontractstosellU.S.dollarsandpurchaseCanadiandollarswith

anaggregatenotionalvalueofU.S.$10.0million(2002–$nil,2001–$nil).Thesecontractscarryaweighted

averageexchangerateofU.S.$1.00equalsCanadian$1.5706,andmatureonDecember1,2003.These

contractshavebeendesignatedasfairvaluehedges,withgainsandlossesonthehedgeinstruments

beingrecognizedinearningseachperiod,offsettingthechangeintheU.S.dollarvalueofthehedged

liability.AsatMarch1,2003,thenotionalgainontheseforwardcontractswasapproximately$419(2002–

n/a,2001–n/a).

Tosatisfyshort-termanticipatedcashrequirements,theCompanyhasenteredintoaforward

foreignexchangecontracttopurchaseU.S.dollarsandsellCanadiandollarswithanotionalvalueof

U.S.$1.3million(2002–$nil,2001–$nil).ThiscontractcarriesanexchangerateofU.S.$1.00equals

Canadian$1.5313,andmaturesonMarch3,2003.Duetotheshort-termnatureofthecontract,itwas

notdesignatedforhedgeaccountingandiscarriedonthebalancesheetatfairvalue.AsatMarch1,2003,

thenotionallossonthisforwardcontractwasapproximately$42(2002–n/a,2001–n/a).

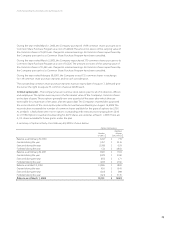

TheCompanyisexposedtocreditriskonderivativenancialinstrumentsarisingfromthepotentialfor

counter-partiestodefaultontheircontractualobligationstotheCompany.TheCompanylimitsthisrisk

bydealingwithnanciallysoundcounter-partiesandbycontinuouslymonitoringthecreditworthiness

ofallcounter-parties.AsatMarch1,2003,themaximumexposuretoasinglecounter-partywas37%of

outstandingderivativeinstruments(2002–50%).

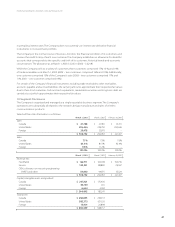

TheCompanyisexposedtomarketandcreditriskonitsinvestmentportfolio.TheCompanylimitsthis

riskbyinvestingonlyinhighlyliquid,investmentgradesecuritiesandbylimitingexposuretoanyone

entityorgroupofentities.AsatMarch1,2003,nosingleissuerrepresentedmorethan5%ofthetotal

cash,cashequivalents,marketablesecurities,andlong-termportfolioinvestments(2002–nosingle

issuerrepresentedmorethan5%ofthetotalcash,cashequivalentsandmarketablesecurities).

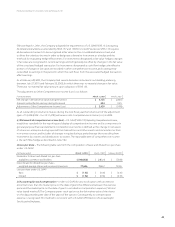

TheCompanyisexposedtointerestrateriskasaresultofholdinginvestmentsofvaryingmaturities.

Thefairvalueofshort-terminvestments,marketablesecurities,andlong-termportfolioinvestments,

aswellastheinvestmentincomederivedfromtheinvestmentportfolio,willuctuatewithchanges