Blackberry 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

37

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

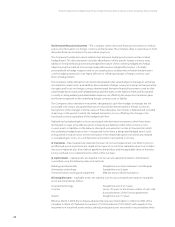

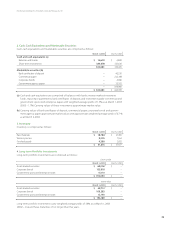

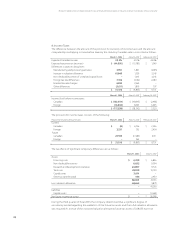

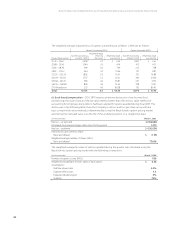

8.IncomeTaxes

Thedifferencebetweentheamountoftheprovisionfor(recoveryof)incometaxesandtheamount

computedbymultiplyingincomebeforetaxesbythestatutoryCanadianrateisreconciledasfollows:

March1,2003 March2,2002 February28,2001

ExpectedCanadiantaxrate 38.3% 41.2% 44.0%

Expectedtaxprovision(recovery) $ (44,990) $ (15,785) $ 1,549

Differencesintaxesresultingfrom:

Manufacturingandprocessingactivities 3,951 1,801 (1,095)

Increaseinvaluationallowance 61,969 1,530 3,245

Non-deductibleportionofunrealizedcapitallosses – 1,013 3,245

Foreigntaxratedifferences 7,352 (3,192) 2,080

Enactedtaxratechanges 4,835 2,960 –

Otherdifferences (2,011) 1,810 707

$ 31,106 $ (9,863) $ 9,731

March1,2003 March2,2002 February28,2001

Income(loss)beforeincometaxes:

Canadian $(102,954) $ (46,845) $ (2,485)

Foreign (14,604) 8,503 6,005

$ (117,558) $ (38,342) $ 3,520

Theprovisionforincometaxesconsistsofthefollowing:

Provisionfor(recoveryof)incometaxes: March1,2003 March2,2002 February28,2001

Current

Canadian $ (8) $ 6,756 $ 2,296

Foreign 3,521 302 2,424

Future

Canadian 27,593 (17,283) 5,011

Foreign – 362 –

$ 31,106 $ (9,863) $ 9,731

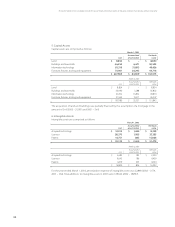

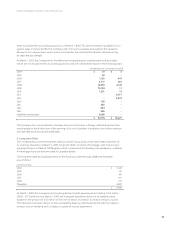

Thetaxeffectsofsignicanttemporarydifferencesareasfollows:

March1,2003 March2,2002

Assets

Financingcosts $ 4,398 $ 6,856

Non-deductiblereserves 6,622 5,004

Researchanddevelopmentincentives 24,897 17,726

Taxlosses 29,938 15,100

Capitalassets 2,614 –

Othertaxcarryforwards 186 2,450

68,655 47,136

Less:valuationallowance 68,655 5,870

– 41,266

Liabilities

Capitalassets – 12,668

Netfutureincometaxassets $ – $ 28,598

Duringthethirdquarterofscal2003,theCompanydeterminedthatasignicantdegreeof

uncertaintyexistedregardingtherealizationofthefuturetaxassetsandthatafullvaluationallowance

wasrequired.Asaresultoftheincreasedvaluationallowance,futuretaxassetsof$68,655havenot