Blackberry 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

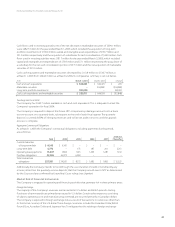

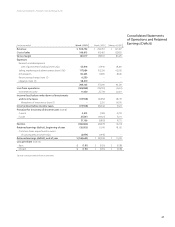

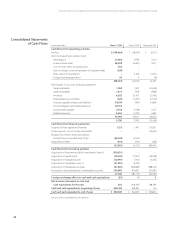

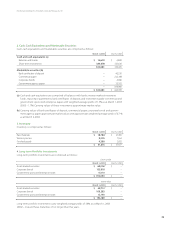

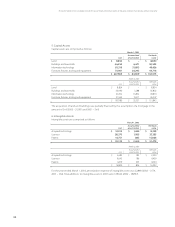

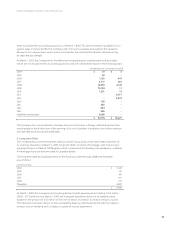

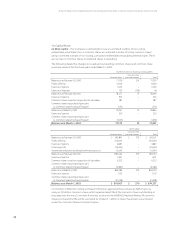

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

31

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

eventsorchangesincircumstancesindicatethattheircarryingamountmaynotberecoverable.

Ifsuchaneventoccurs,theintangibleassetiswrittendowntoitsrecoverablevalue.Therewasno

impacttoretainedearningsasaresultoftheadoptionofthisrecommendation.

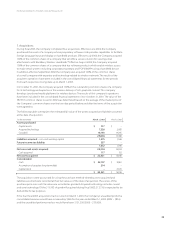

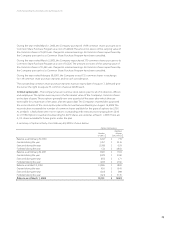

(l)Goodwill–EffectiveMarch3,2002,theCompanyadoptedthenewrecommendationsofSection

3062oftheCanadianInstituteofCharteredAccountants(“CICA”)Handbook(“CICA3062”)withregards

togoodwillandintangibleassetsandaccordingly,goodwillisnolongeramortizedtoearnings,but

periodicallytestedforimpairment.Uponadoptionofthesenewrecommendations,goodwillmustbe

testedforimpairmentasofthebeginningofthecurrentyear.TheCompanyperformedtherequired

impairmenttestsofgoodwillasatMarch1,2003andMarch3,2002andconcludedthattheexisting

goodwillwasnotimpaired.TheCompanydidnothaveanygoodwillpriortotheadoptionofthenew

recommendation,therefore,therewasnoimpacttoprioryear’searningsuponitsadoption.

Goodwillrepresentstheexcessofthepurchasepriceofbusinessacquisitionsoverthefairvalue

ofidentiablenetassetsacquiredinsuchacquisitions.Goodwillisallocatedasatthedateofthe

businesscombination.Goodwillisnotamortized,butistestedforimpairmentannually,ormore

frequentlyifeventsorchangesincircumstancesindicatetheassetmightbeimpaired.

Theimpairmenttestiscarriedoutintwosteps.Intherststep,thecarryingamountofthereporting

unitincludinggoodwilliscomparedwithitsfairvalue.Whenthefairvalueofareportingunitexceeds

itscarryingamount,goodwillofthereportingunitisconsiderednottobeimpaired,andthesecond

stepisconsideredunnecessary.

Intheeventthatthefairvalueofthereportingunit,includinggoodwill,islessthanthecarrying

value,theimpliedfairvalueofthereportingunit’sgoodwilliscomparedwithitscarryingamountto

measuretheamountoftheimpairmentloss,ifany.Theimpliedfairvalueofgoodwillisdetermined

inthesamemannerasthevalueofgoodwillisdeterminedinabusinesscombinationusingthefair

valueofthereportingunitasifitwasthepurchaseprice.Whenthecarryingamountofthereporting

unitgoodwillexceedstheimpliedfairvalueofthegoodwill,animpairmentlossisrecognizedinan

amountequaltotheexcessandispresentedasaseparatelineitemintheconsolidatedstatements

ofoperationsandretainedearnings.

TheCompanyhasonereportingunit,whichistheconsolidatedCompany.

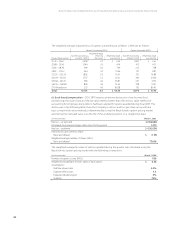

(m)Incometaxes–Theliabilitymethodoftaxallocationisusedtoaccountforincometaxes.Under

thismethod,futuretaxassetsandliabilitiesaredeterminedbasedupondifferencesbetweenthe

nancialreportingandtaxbasesofassetsandliabilities,andmeasuredusingthesubstantively

enactedtaxratesandlawsthatwillbeineffectwhenthedifferencesareexpectedtoreverse.

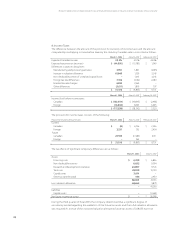

(n)Revenuerecognition–TheCompanyrecognizesrevenuewhenitisrealizedorrealizableand

earned.TheCompanyconsidersrevenuerealizedorrealizableandearnedwhenithaspersuasive

evidenceofanarrangement,theproducthasbeendeliveredortheserviceshavebeenprovided

tothecustomer,thesalespriceisxedordeterminableandcollectibilityisreasonablyassured.In

additiontothisgeneralpolicy,thefollowingarethespecicrevenuerecognitionpoliciesforeach

majorcategoryofrevenue.

HandheldandotherhardwareproductsRevenuefromthesaleofhardware,originalequipment

manufacturer(“OEM”)andaccessoriesarerecognizedwhentitleistransferredtothecustomerand

allsignicantcontractualobligationsthataffectthecustomer’snalacceptancehavebeenfullled.

Provisionsaremadeatthetimeofsaleforwarranties,royaltiesandestimatedproductreturns.For

hardwareproductsforwhichthesoftwareisdeemednottobeincidental,theCompanyrecognizes

revenueinaccordancewiththeAmericanInstituteofCertiedPublicAccountantsStatementof

Position97-2,SoftwareRevenueRecognition(“SOP97-2”).