Blackberry 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

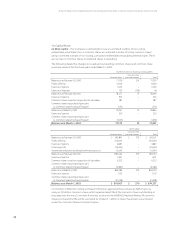

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

41

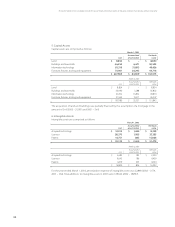

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

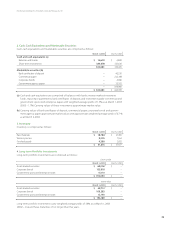

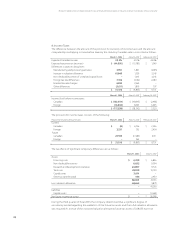

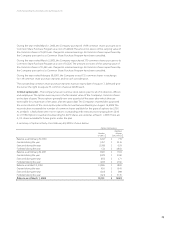

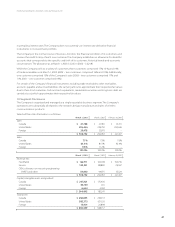

TheweightedaveragecharacteristicsofoptionsoutstandingasatMarch1,2003areasfollows:

OptionsOutstanding(000’s) OptionsExercisable(000’s)

Weightedaverage

NumberOutstanding remaining Weightedaverage NumberOutstanding Weightedaverage

Rangeofexerciseprices atMarch1,2003 lifeinyears exerciseprice atMarch1,2003 exerciseprice

$2.43–$3.62 2,058 3.7 $ 2.69 1,847 $ 2.61

$3.88–$5.66 1,544 2.6 4.14 415 4.31

$5.93–$8.78 699 3.0 7.69 233 7.68

$8.97–$13.12 464 4.7 10.26 127 9.87

$13.55–$20.29 1,802 5.6 16.41 351 16.84

$20.39–$30.51 1,737 5.3 23.51 392 24.60

$30.68–$45.51 683 4.6 36.87 237 37.52

$46.55–$68.48 839 4.6 51.65 338 51.31

$70.44andover 275 4.6 86.58 130 86.47

Total 10,101 4.3 $ 18.29 4,070 $ 15.40

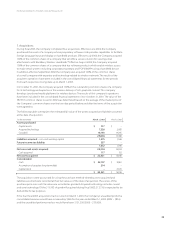

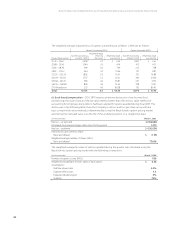

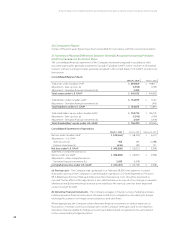

(c)Stock-basedcompensation–CICA3870requiresproformadisclosuresofnetincome(loss)

andearnings(loss)pershare,asifthefairvaluemethodratherthantheintrinsicvaluemethodof

accountingforemployeestockoptionshadbeenappliedforgrantsawardedduringscal2003.The

disclosuresinthefollowingtableshowtheCompany’snetlossandlosspershareonaproforma

basisusingthefairvaluemethod,asdeterminedbyusingtheBlack-Scholesoptionpricingmodel,

amortizingtheindicatedvalueoverthelifeoftheunderlyingoptiononastraight-linebasis:

Fortheyearended March1,2003

Netloss–asreported $(148,664)

Estimatedstock-basedcompensationcostsfortheperiod 1,370

Netloss–proforma $(150,034)

Proformalosspercommonshare:

Basicanddiluted $ (1.93)

Weightedaveragenumberofshares(000’s):

Basicanddiluted 77,636

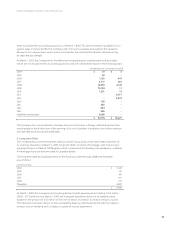

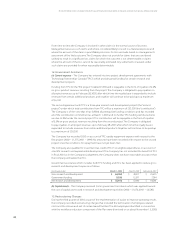

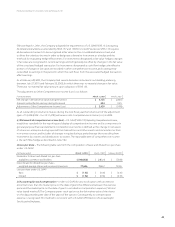

Theweightedaveragefairvalueofoptionsgrantedduringthequarterwascalculatedusingthe

Black-Scholesoption-pricingmodelwiththefollowingassumptions:

Fortheyearended March1,2003

Numberofoptionsissued(000’s) 956

WeightedaverageBlack-Scholesvalueofeachoption $ 8.58

Assumptions:

Riskfreeinterestrate 4.5%

Expectedlifeinyears 3.5

Expecteddividendyield 0%

Volatility 70%