Blackberry 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

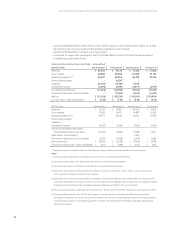

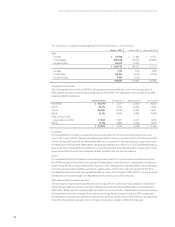

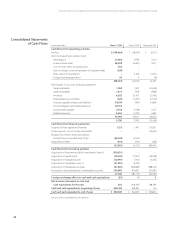

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

23

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

uctuations,theCompanymaintainsnetmonetaryassetand/orliabilitybalancesinforeigncurrencies

andengagesinforeigncurrencyhedgingactivitiesthroughtheutilizationofderivativenancialinstru-

ments.TheCompanydoesnotpurchaseorholdanyderivativeinstrumentsforspeculativepurposes.

Tohedgeexposuresrelatingtoforeigncurrencyanticipatedtransactions,theCompanyhasentered

intoforwardforeignexchangecontractstosellU.S.dollarsandpurchaseCanadiandollarswithan

aggregatenotionalvalueofU.S.$58.1millionasatMarch1,2003(2002–$87.5million).Thesecontracts

carryaweightedaveragerateofU.S.$1.00equalsCanadian$1.5831,andmatureatvariousdates,with

thelatestbeingDecember1,2003.Thesecontractshavebeendesignatedascashowhedges,with

gainsandlossesonthehedgeinstrumentsbeingrecognizedinthesameperiodas,andaspartof,the

hedgedtransaction.AsatMarch1,2003,thenotionalgainontheseforwardcontractswasapproxi-

mately$3,439(2002–notionallossof$1,478).

Tohedgeexposurerelatingtoforeigncurrencydenominatedlong-termdebt,theCompanyhas

enteredintoforwardforeignexchangecontractstosellU.S.dollarsandpurchaseCanadiandollarswith

anaggregatenotionalvalueofU.S.$10.0million(2002–$nil).Thesecontractscarryaweightedaverage

exchangerateofU.S.$1.00equalsCanadian$1.5706,andmatureonDecember1,2003.Thesecontracts

havebeendesignatedasfairvaluehedges,withgainsandlossesonthehedgeinstrumentsbeing

recognizedinearningseachperiod,offsettingthechangeintheU.S.dollarvalueofthehedgedliability.

AsatMarch1,2003,thenotionalgainontheseforwardcontractswasapproximately$419(2002–n/a).

ThemajorityoftheCompany’scash,cashequivalentsandmarketablesecuritiesaredenominated

inU.S.dollarsasatMarch1,2003.

InterestRate

Cash,cashequivalentsandmarketablesecuritiesareinvestedincertaininstrumentsofvaryingshort-

termmaturities;consequentlytheCompanyisexposedtointerestrateriskasaresultofholding

investmentsofvaryingmaturitiesuptooneyear.Thefairvalueofmarketablesecurities,aswellasthe

investmentincomederivedfromtheinvestmentportfolio,willuctuatewithchangesinprevailing

interestrates.TheCompanydoesnotcurrentlyuseinterestratederivativenancialinstrumentsinits

investmentportfolio.

CreditandCustomerConcentration

TheCompanyisundergoingsignicantexternalsalesgrowthinternationallyandtheresultinggrowth

initscustomerbaseintermsofbothnumbersandinsomeinstancesincreasedcreditlimits.The

Company,inthenormalcourseofbusiness,monitorsthenancialconditionofitscustomersand

reviewsthecredithistoryofeachnewcustomer.TheCompanyestablishesanallowancefordoubtful

accountsthatcorrespondstothespeciccreditriskofitscustomers,historicaltrendsandeconomic

circumstances.TheCompanyalsoplacesinsurancecoverageforaportionofitsforeigntradereceiv-

ableswithExportDevelopmentCorporation.

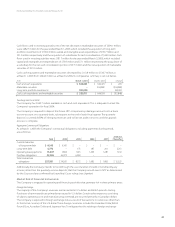

WhiletheCompanysellstoavarietyofcustomers,threecustomerscomprised17%,16%,and14%of

tradereceivablesasatMarch1,2003(2002–twocustomerscomprised16%and15%).Additionally,one

customercomprised12%oftheCompany’ssales(2002–twocustomerscomprised17%and11%).

Forward-LookingStatements

Forward-lookingstatementsinthisAnnualReportaremadepursuanttothe“safeharbor”provisions

oftheUnitedStatesPrivateSecuritiesLitigationReformActof1995.Whenusedherein,wordssuch

as“intend,anticipate,estimate,expect,believe,will,predicts”andsimilarexpressionsareintendedto

identifyforward-lookingstatements.Forward-lookingstatementsarebasedonassumptionsmadeby

andinformationavailabletoResearchInMotionLimited.Investorsarecautionedthatsuchforward-

lookingstatementsinvolverisksanduncertainties.