Blackberry 2003 Annual Report Download - page 17

Download and view the complete annual report

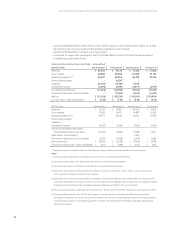

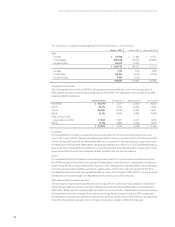

Please find page 17 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

15

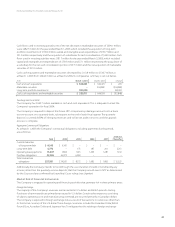

GrossMargin

Grossprotincreasedto$140.1millionor45.7%ofrevenueinthecurrentscalyear,comparedto

$98.6millionor33.5%inthepreviousyear.TheCompanyrecordeda$16.1millionwrite-downofthe

carryingvaluesofitsinventoriesoflegacycomponentrawmaterialspartsduringthesecondquarter

ofscal2002.Theinventorywrite-downwaschargedtoCostofsalesontheConsolidatedStatementof

OperationsandDecit.Grossmarginforscal2002,adjustedfortheimpactofthiswrite-down,was39.0%.

ThisadjustedgrossmarginguredoesnothaveanystandardizedmeaningprescribedbyGAAPandis

notcomparabletosimilarmeasurespresentedbyothercompanies.

Thenetincreaseingrossmarginto45.7%versus39.0%,asadjusted,forscal2002wasprimarilydueto:

• ahigherpercentageofservicerevenueinthescal2003productmix

• highermarginsoftwarerevenuemadeupagreaterpercentageofoverallproductmixinscal2003

• improvedhandheldmarginsasaresultofthefavourableimpactofsuppliercostreductionsfor

certainrawmaterialcomponentparts

TrendingintoFiscal2004

TheCompanyexpectsitsgrossmarginpercentagetodeclineinscal2004fromthe45.7%realized

inscal2003.

Handheldproductmixhasasignicantimpactonhandheldmarginsascertainproductlinesrealize

lowermarginsthanothersbecausecostofgoodssoldforhandheldsincludematerials,labourand

overheadtogetherwithotherdirectnon-manufacturingcostssuchasroyaltiesandwarranty.

Additionally,RIMexpectsitsASPforhandheldproductlinesandresultinghandheldgrossmargin

todeclineinscal2004over2003asaresultofbroadeningRIM’smarketsharebyintroducingnew

productswithlowerpricepointsfortheprosumermarket.

TheCompanywillattempttooffsetaportionofthishandheldgrossmarginerosionthrough

reductionsinitsproductbillsofmaterialcostasaresultofnegotiatingfurthercomponentpartscost

reductionsandthroughimprovingmanufacturingefciencies.Beginningwiththefourthquarterof

scal2003,RIMhasbeenabletorelyonitshigherconrmedproductionbacklogtorealizemanufac-

turingcosteconomiesbyeveningoutitsproductionstreamoverthethirteenweekquarterlycycles,

whichresultsinlowernon-standardmanufacturingcostssuchasdirectlabourovertimeandhigher

capacityutilization.Additionally,theCompany’shandheldandconsolidatedgrossmarginwillcontinue

tobeinuencedbythedeterminationofobsoleteorexcessinventory.

TheCompany’sserviceandconsolidatedgrossmarginwillbeinuencedbythechangeinthe

percentagemixfromBlackBerrydirectsubscriberstocarrier-owned2.5GBlackBerrysubscribers.

TheCompany’sconsolidatedgrossmarginwillalsobeinuencedbythechangeintheoverallrevenue

mixamonghandhelds,serviceandsoftwareaswellasanyimpactofBlackBerryConnectandTechnical

SupportServicesrevenues.

Expenses

Expenses,asreportedontheConsolidatedStatementofOperationsandDecitandexcludingRestructuring

chargesandLitigation,arecomprisedofresearchanddevelopment,selling,marketingandadministrative

expensesandamortization.

AsaresultofRIM’srestructuringplanlateinthescal2003thirdquarteraswellastheexpectedfuture

quarterlyandannualcostssavingsthatmanagementistargeting(seeRestructuringChargeslaterinthis

MD&Aandnote13totheConsolidatedFinancialStatements),theCompanybelievesthatthescal2003

annualexpenseguresforresearchanddevelopment,selling,marketingandadministrativeexpenses

andamortizationarenotameaningfulreferencepoint.Additionally,RIMincurredthelargestportionof

itsannualmarketingprogramcostsduringthethirdquarterofscal2003.Consequently,theCompany

believesthatitsexpenselevelsinthefourthquarterofscal2003providemoremeaningfulforward-

lookinganalysis.