Blackberry 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

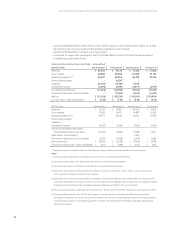

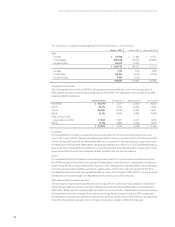

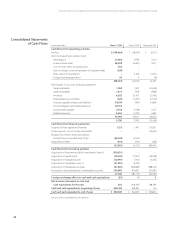

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

19

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

TheCourtdidnotruleatthattimeonotherpost-trialmotionsandorderedthepartiestomediation

beforeaU.S.MagistrateJudge.Nodenitivetimeframewassetforthemediationprocess.

OnMay23,2003theCourtruledasfollows:i)theCourtorderedthatNTPbeawardedcompensatory

damagessuchthatallinfringingrevenuessubsequenttothedateofthejuryverdictareenhanced

byafactorof0.5or50%to8.55%andthatinfringingrevenuesnowincludeallBlackBerryhandheld,

serviceandsoftwarerevenuesintheUnitedStates;ii)theCourtorderedthatNTPbeawardedplaintiff’s

attorneyfeesfortheperioduptoFebruary22,2003,atafactorof0.8or80%ofactualfeesincurredby

NTPinthismatter;andiii)theCourtorderedthatpostjudgementinterestbecomputedonenhanced

compensatorydamages.

TheCourthasnotyetruledonothermatters,includingwhetherornotaninjunctionwillbegranted

toNTP.

AstheMay23,2003rulingwasreceivedbeforethecompletionoftheCompany’sannualconsolidated

nancialstatements,theCompanyrecorded,duringthefourthquarterofscal2003,anexpense

of$25.5millionwithrespecttotheNTPmattertoprovideforadditionalestimatedcompensatory

damagesfortheperiodNovember1,2002toFebruary28,2003;enhancedcompensatorydamages

awardedbytheCourt,plaintiff’sattorneyfeesawardedbytheCourt,prejudgmentinterestfrom

thedateoftheCompany’srstallegedinfringingactivitytothejuryverdictonNovember21,2002,

postjudgmentinterestfortheperiodNovember22,2002toMarch1,2003;andadditionalcurrentand

estimatedfuturecostswithrespecttoongoinglegalfees.

ThetotalexpenserecordedinrelationtotheNTPmatterforthescalyearis$58.2million.

Asofthecompletionoftheseconsolidatednancialstatements,thelikelihoodofanyfurtherlossand

theultimateamountofloss,ifany,wasnotreasonablydeterminable;consequently,theCompanyhas

notrecordedanyadditionalamountsfromthosenotedabove.

TheCompany’smanagementremainsoftheviewthattheCompany’sproductsandservicesdonot

infringeuponanyofNTP’spatentsandthatthepatentsareinvalid.TheCompanywillcontinueto

contestthismatter.

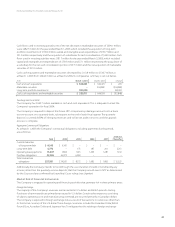

TrendingintoFiscal2004

TheCompanyanticipatesthatthescal2004quarterlyearningschargewithrespecttoestimated

compensatorydamages,estimatedenhanced(byafactorof0.5)compensatorydamagesand

estimatedpostjudgmentinterestbebetween$8.0millionto$9.0millionforeachofthersttwo

quartersandincreasethereafterasthequarterlycompensatorydamagesarevariabletotheCompany’s

expected2004BlackBerryrevenuegrowth,themajorityofwhichwouldbeinfringingrevenues,as

determinedbytheCourt.

InvestmentIncome

Investmentincomedecreasedinscal2003by$14.3millionto$11.4millionfrom$25.7millioninthe

yearendedMarch2,2002.Thedecreasereectsloweraverageinterestratesrealizedinthecurrent

yearversustheprioryear.Additionally,theCompany’saveragetotalbalanceofcash,cashequiva-

lents,marketablesecuritiesandlong-termportfolioinvestmentswaslowerduringthecurrentyear

comparedwiththecomparableaveragetotalbalanceofcash,cashequivalentsandmarketable

securitiesintheprecedingscalyear.Theweightedaverageyieldforcashandcashequivalentsasat

March1,2003is1.3%(March2,2002–1.7%)andwas2.7%formarketablesecuritiesasatMarch2,2002.

Duringscal2003theCompanyinvested$190.0millioninlong-termportfolioinvestmentsthathave

anaverageyieldof3.8%asatMarch1,2003.