Blackberry 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

49

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

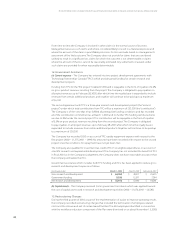

EffectiveMarch1,2001,theCompanyadoptedtherequirementsofU.S.GAAP,SFAS133,Accounting

forDerivativeInstruments,asamendedbySFAS137and138,forU.S.GAAPpurposes.SFAS133requires

allderivativeinstrumentstoberecognizedatfairvalueontheconsolidatedbalancesheet,and

outlinesthecriteriatobemetinordertodesignateaderivativeinstrumentasahedgeandthe

methodsforevaluatinghedgeeffectiveness.Forinstrumentsdesignatedasfairvaluehedges,changes

infairvaluearerecognizedincurrentearnings,andwillgenerallybeoffsetbychangesinthefairvalue

oftheassociatedhedgedtransaction.Forinstrumentsdesignatedascashowhedges,theeffective

portionofchangesinfairvaluearerecordedinothercomprehensiveincome,andsubsequently

reclassiedtoearningsintheperiodinwhichthecashowsfromtheassociatedhedgedtransaction

affectearnings.

AsatFebruary28,2001,theCompanyhadseveralderivativeinstrumentsoutstanding,maturing

betweenJuly27,2001andFebruary22,2002,forwhichtherewasnomaterialchangeinfairvalue.

TherewasnomaterialfairvalueamountuponadoptionofSFAS133.

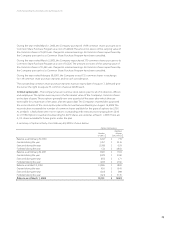

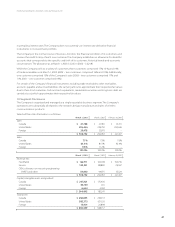

TheadjustmenttoOtherComprehensiveIncome(Loss)isasfollows:

Fortheyearended March1,2003 March2,2002

Netchangeinderivativefairvalueduringtheperiod $ 3,155 $ (2,803)

Amountsreclassiedtoearningsduringtheperiod 284 1,325

AdjustmenttoOtherComprehensiveIncome(Loss) $ 3,439 $ (1,478)

Asalloutstandinginstrumentsmatureduringthenextscalyear,thefullamountoftheadjustment

(gainof$3,439(2002–lossof$1,478))willreverseintoComprehensiveIncome(Loss)in2004.

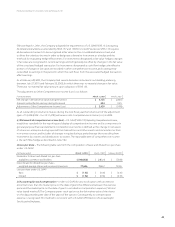

(c)Statementsofcomprehensiveincome(loss)–U.S.GAAP,SFAS130,ReportingComprehensiveIncome,

establishesstandardsforthereportinganddisplayofcomprehensiveincomeanditscomponentsin

general-purposenancialstatements.Comprehensiveincomeisdenedasthechangeinnetassets

ofabusinessenterpriseduringaperiodfromtransactionsandothereventsandcircumstancesfrom

non-ownersources,andincludesallchangesinequityduringaperiodexceptthoseresultingfrom

investmentsbyownersanddistributionstoowners.Thereportableitemofcomprehensiveincome

isthecashowhedgeasdescribedinnote21(b).

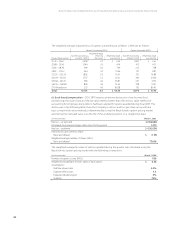

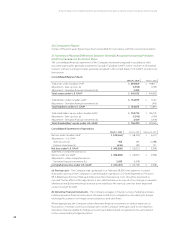

(d)Losspershare–Thefollowingtablesetsforththecomputationofbasicanddilutedlosspershare

underU.S.GAAP.

Fortheyearended March1,2003 March2,2002 February28,2001

Numeratorforbasicanddilutedlosspershare

availabletocommonstockholders $(148,858) $ (28,321) $ (7,568)

Denominatorfordilutedlosspershare–

weighted-averagesharesandassumedconversions 77,636 78,467 73,555

LosspershareunderU.S.GAAP

Basic $ (1.92) $ (0.36) $ (0.10)

Diluted $ (1.92) $ (0.36) $ (0.10)

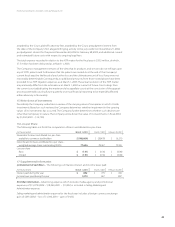

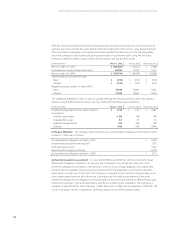

(e)Accountingforstockcompensation–UnderU.S.GAAP,foranystockoptionwithanexercise

pricethatislessthanthemarketpriceonthedateofgrant,thedifferencebetweentheexercise

priceandthemarketpriceonthedateofgrantisrecordedascompensationexpense(“intrinsic

valuebasedmethod”).TheCompanygrantsstockoptionsatthefairmarketvalueoftheshares

onthedayprecedingthedateofthegrantoftheoptions.Consequently,nocompensation

expenseisrecognized.ThismethodisconsistentwithU.S.GAAP,APBOpinion25,Accountingfor

StockIssuedtoEmployees.