Blackberry 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

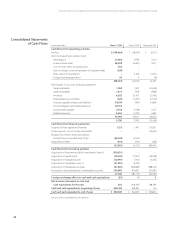

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

21

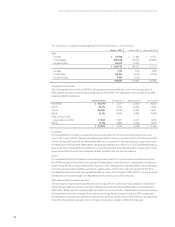

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

Write-DownofInvestments

TheCompanymadeseveralstrategicinvestmentsintechnologycompaniesinscal2001,representing

ownershippositionsoflessthan10%.TheCompanydidnotexercisesignicantinuencewithrespect

toanyofthesecompanies.

TheCompanyreviewsthecarryingvaluesofitsinvestmentstodetermineifadeclineinvalueother

thantemporaryinnaturehasoccurred.Duringscal2002,theCompanyreviewedtheremaining

carryingvaluesoftheseinvestmentsanddeterminedthatthenancial,operationalandstrategic

circumstancesrelatingtomostoftheseinvestmentswarrantedawrite-downofthecarryingvalues.

Consequently,theCompanyrecordedareductionofitsinvestmentsintheamountof$5.3million

duringthesecondquarterof2002.

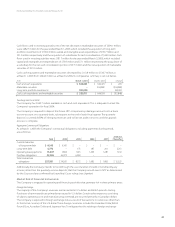

IncomeTaxes

TheCompanyrecordedanincometaxexpenseof$31.1milliononitspre-taxlossof$117.6million.

Duringthethirdquarterofscal2003,theCompanydeterminedthatitwasnolongerabletosatisfy

the“morelikelythannot”standardunderGAAPwithrespecttothevaluationofitsfutureincometax

assetbalance.Consequently,theCompanyrecordedafutureincometaxprovisionof$27.6million

forscal2003.Thevaluationallowance,combinedwiththedecisiontoreportresultsfromoperations

withouttaxeffectinglossesbeginninginthethirdquarterof2003,resultedinunrecognizedincometax

benetsof$68.7millionasatMarch1,2003.Thesenetfuturetaxassetshaveasubstantiallyunlimited

lifeandremainavailableforuseagainsttaxesonfutureprots.TheCompanywillcontinuetoevaluate

andexaminethevaluationallowanceonaregularbasisandasfutureuncertaintiesareresolved,the

valuationallowancemaybeadjustedaccordingly.TheCompanyhasnotprovidedforCanadianfuture

incometaxesorforeignwithholdingtaxesthatwouldapplyonthedistributionoftheearningsofits

non-Canadiansubsidiaries,sincetheseearningsareintendedtobereinvestedindenitely.

TheCompany’sscal2002consolidatedneteffectivetaxratewas25.7%andwasmateriallyaffectedby

theimpactofthewrite-downofinvestments,whichresultedinancapitallossthatwasnottaxeffected

andvaryingtaxratesindifferentforeignjurisdictions.

NetLoss

Netlosswas$148.7millionor$1.91basicanddilutedinscal2003versus$28.5millionor$0.36basic

anddilutedintheprioryear.

LiquidityandCapitalResources

Cashowsgeneratedfromoperatingactivitieswere$2.8millioninthecurrentscalyearcompared

tocashowgeneratedfromoperatingactivitiesof$17.7millionintheprioryear.Theprimaryfactorin

thereductionwastheincreaseinthepre-taxlossto$98.9millioninscal2003from$38.3millioninthe

prioryear.Non-cashworkingcapitalgenerated$72.4millioninscal2003versus$40.0millioninthe

prioryear,anincreaseof$32.4million,assummarizedinthefollowingtable:

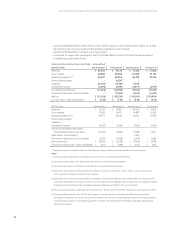

Workingcapital

Asat March1,2003 March2,2002 fundsgenerated

Tradereceivables 40,803 42,642 1,839

Otherreceivables 4,538 5,976 1,438

Inventories 31,275 37,477 6,202

Accountspayableandaccruals 73,009 46,934 26,075

Accruedlitigation 32,037 – 32,037

Deferredrevenue 14,336 9,773 4,563

Cashowsusedinnancingactivitieswere$24.0millionforthecurrentyear,includingthebuyback

ofcommonsharesof$24.5millionpursuanttotheCompany’sCommonSharePurchaseProgram.

Cashowsusedinnancingactivitiesforscal2002were$4.3millionforthecurrentyearwhich

includedthebuybackofcommonsharesof$5.5millionpursuanttotheCompany’sCommonShare

PurchaseProgram.