Blackberry 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

49

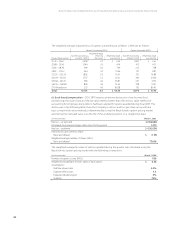

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

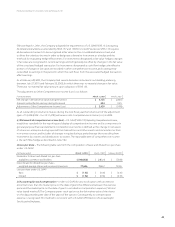

20.ComparativeFigures

Certainoftheprioryears’gureshavebeenreclassiedforconsistencywiththecurrentpresentation.

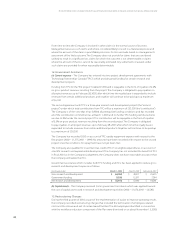

21.SummaryofMaterialDifferencesBetweenGenerallyAcceptedAccountingPrinciples

(GAAP)inCanadaandtheUnitedStates

TheconsolidatednancialstatementsoftheCompanyhavebeenpreparedinaccordancewith

accountingprinciplesgenerallyacceptedinCanada(“CanadianGAAP”)whichconforminallmaterial

respectswithaccountingprinciplesgenerallyacceptedintheUnitedStates(“U.S.GAAP”)exceptasset

forthbelow:

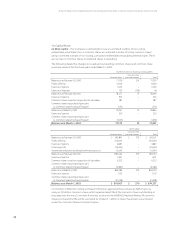

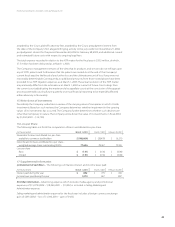

ConsolidatedBalanceSheets

March1,2003 March2,2002

TotalassetsunderCanadianGAAP $ 859,609 $ 948,157

Adjustment–Start-upcosts(a) (1,393) (1,199)

Adjustment–Derivativenancialinstruments(b) 3,439 –

TotalassetsunderU.S.GAAP $ 861,655 $ 946,958

TotalliabilitiesunderCanadianGAAP $ 154,875 $ 71,412

Adjustment–Derivativenancialinstruments(b) – 1,478

TotalliabilitiesunderU.S.GAAP $ 154,875 $ 72,890

Totalshareholders’equityunderCanadianGAAP $ 704,734 $ 876,745

Adjustment–Start-upcosts(a) (1,393) (1,199)

Adjustment–Derivativenancialinstruments(b) 3,439 (1,478)

Totalshareholders’equityunderU.S.GAAP $ 706,780 $ 874,068

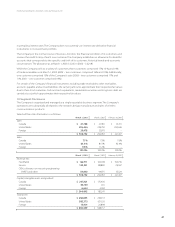

ConsolidatedStatementsofOperations

March1,2003 March2,2002 February28,2001

NetlossunderCanadianGAAP $(148,664) $ (28,479) $ (6,211)

Adjustments–U.S.GAAP

Start-upcosts(a) 452 243 (2,088)

Futureincometaxes(a) (646) (85) 731

NetlossunderU.S.GAAP$(148,858) $ (28,321) $ (7,568)

Statementofcomprehensiveloss(c)

NetlossunderU.S.GAAP $(148,858) $ (28,321) $ (7,568)

Adjustments–othercomprehensiveloss

Derivativenancialinstruments(b) 3,439 (1,478) –

ComprehensivelossunderU.S.GAAP $(145,419) $ (29,799) $ (7,568)

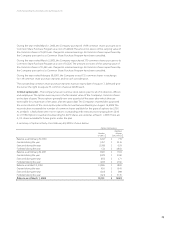

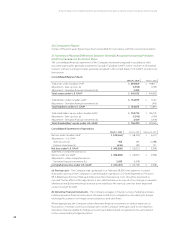

(a)Start-upcosts–TheCompanyhadcapitalizedasatFebruary28,2001theexpensesincurred

duringthestart-upoftheCompany’sUnitedKingdomoperations.U.S.GAAP,StatementofPosition

98-5,ReportingontheCostofStart-upActivities,prescribesthatstart-upcostsshouldbeexpensedas

incurred.Thetaxaffectofthisadjustmentisalsoreectedabove.Asaresultofourchangeinvaluation

allowance(note8),theremainingfuturetaxassetrelatingtothestart-upcostshasbeenexpensed

underU.S.GAAPfor2003.

(b)DerivativeFinancialInstruments–TheCompanyengagesinforeigncurrencyhedgingactivities,

utilizingderivativenancialinstruments(forwardcontracts),tomitigatetherisksrelatingtoforeign

exchangeuctuationsonforeigncurrencybalancesandcashows.

Whereappropriate,theCompanyutilizesderivativenancialinstrumentstoreduceexposureto

uctuationsinforeigncurrencyexchangerates.UnderCanadianGAAP,gainsandlossesrelatedto

derivativesthatareeligibleforhedgeaccountingaredeferredandrecognizedinthesameperiod

asthecorrespondinghedgedpositions.