Bed, Bath and Beyond 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Several of the Company’s key initiatives include: continuing to add new functionality and assortment to its selling websites,

mobile sites and applications; continuing the deployment of systems, equipment and increased bandwidth in the Company’s

stores, which enables store associates to lower the Company’s shipping costs for home deliveries, improves inventory ordering,

optimizes work force management and enables customer Wi-Fi and new multi-function devices for store associates; improving

customer data integration and customer relations management capabilities; continuing to strengthen and deepen its

information technology, analytics, marketing and e-commerce groups; furthering the development work necessary for a new

and more robust point of sale system; and opening an additional distribution facility to support the growth of the online

direct to customer channel and for health and beauty care offerings. These and other investments are expected to, among

other things, provide a seamless and compelling customer experience across the Company’s in-store, online and mobile

shopping environments.

During fiscal 2014, the Company opened a total of 22 new stores and closed five stores. The Company plans to continue to

optimize its store operations and market coverage by expanding, downsizing, renovating, opening, closing and relocating

stores. In fiscal 2015, the Company expects to open approximately 30 new stores company-wide and a new customer service

contact center. Additionally, during fiscal 2015, the Company expects to continue to enhance its omnichannel capabilities,

through, among other things, continuing its deployment of systems, equipment and increased bandwidth to the Company’s

stores and continuing its investment in information technology and analytics.

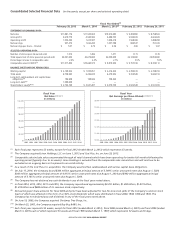

On July 17, 2014, the Company issued $300 million aggregate principal amount of 3.749% senior unsecured notes due

August 1, 2024 (the ‘‘2024 Notes’’), $300 million aggregate principal amount of 4.915% senior unsecured notes due August 1,

2034 (the ‘‘2034 Notes’’) and $900 million aggregate principal amount of 5.165% senior unsecured notes due August 1, 2044

(the ‘‘2044 Notes’’ and, together with the 2024 Notes and the 2034 Notes, the ‘‘Notes’’). The aggregate net proceeds from the

Notes were approximately $1.5 billion, which was used for share repurchases of the Company’s common stock and for general

corporate purposes. Interest on the Notes is payable semi-annually on February 1 and August 1 of each year, beginning on

February 1, 2015.

On July 17, 2014, the Company entered into an accelerated share repurchase agreement (‘‘ASR’’) with an investment bank to

repurchase an aggregate $1.1 billion of the Company’s common stock. The ASR was completed in December 2014. The total

number of shares repurchased under the ASR was 16.8 million shares at a weighted average share price of $65.41.

On August 6, 2014, the Company entered into a $250 million five year senior unsecured revolving credit facility agreement

(‘‘Revolver’’) with various lenders. During the period from August 6, 2014 through February 28, 2015, the Company did not

have any borrowings under the Revolver.

During fiscal 2014, 2013 and 2012, including the shares repurchased under the ASR, the Company repurchased 33.0 million,

18.3 million and 16.1 million shares, respectively, of its common stock at a total cost of approximately $2.251 billion,

$1.284 billion and $1.001 billion, respectively. The Company’s share repurchase program could change, and would be

influenced by several factors, including business and market conditions. In addition, the Company reviews its alternatives with

respect to its capital structure on an ongoing basis.

BED BATH & BEYOND 2014 ANNUAL REPORT

7