Bed, Bath and Beyond 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

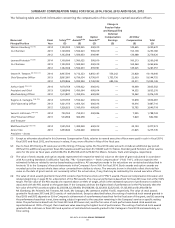

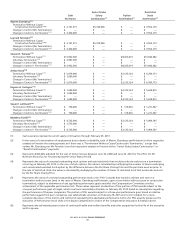

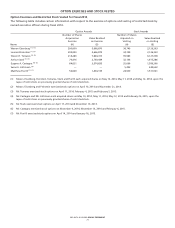

GRANTS OF PLAN BASED AWARDS

Grants of Stock Options and Performance Stock Units for Fiscal 2014

The following table sets forth information with respect to stock options granted and performance stock units awarded during

fiscal 2014 to each of the named executive officers under the Company’s 2012 Incentive Compensation Plan (the ‘‘2012 Plan’’).

The Company did not grant any non-equity incentive plan awards in fiscal 2014.

Name

Estimated Future Payouts Under

Equity Incentive Plan Awards

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(1)

(#)

Exercise or

Base Price

of Option

Awards

(2)

($/Sh)

Closing

Market

Price on

Date of

Grant

($/Sh)

Grant Date

Fair Value of

Stock and

Option

Awards

(3)

($)Grant Date

Threshold

(1)

(#)

Target

(1)

(#)

Maximum

(1)

(#)

Warren Eisenberg 5/12/14 0 24,062 36,093 $ 1,500,025

5/12/14 23,855 $62.34 $62.83 $ 500,010

Leonard Feinstein 5/12/14 0 24,062 36,093 $ 1,500,025

5/12/14 23,855 $62.34 $62.83 $ 500,010

Steven H. Temares 5/12/14 0 155,796 233,695 $ 9,712,323

5/12/14 231,682 $62.34 $62.83 $ 4,856,147

Arthur Stark 5/12/14 0 24,864 37,296 $ 1,550,022

5/12/14 28,626 $62.34 $62.83 $ 600,012

Eugene A. Castagna 5/12/14 0 24,864 37,296 $ 1,550,022

5/12/14 28,626 $62.34 $62.83 $ 600,012

Susan E. Lattmann 5/12/14 0 12,031 18,047 $ 750,013

5/12/14 14,313 $62.34 $62.83 $ 300,006

Matthew Fiorilli 5/12/14 0 20,854 31,281 $ 1,300,038

5/12/14 28,626 $62.34 $62.83 $ 600,012

(1) Number of shares when converted from dollars to shares, which number is rounded up to the nearest whole share.

(2) The exercise price of option awards is the average of the high and low trading prices of the Company’s common stock on the date

of grant.

(3) Pursuant to the SEC rules, stock and option awards are valued in accordance with ASC 718. See footnote 3 to the Summary Compensation

Table in this Proxy Statement.

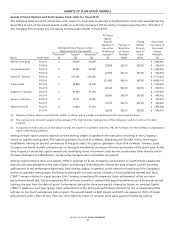

Vesting of stock option awards depends on time vesting, subject in general to the executive remaining in the Company’s

service on specific vesting dates. The options granted in fiscal 2014 to Messrs. Eisenberg and Feinstein vest in three equal

installments starting on the first anniversary of the grant date. The options granted in fiscal 2014 to Messrs. Temares, Stark,

Castagna and Fiorilli and Ms. Lattmann vest in five equal installments starting on the first anniversary of the grant date. At the

time of grant or thereafter, option awards and underlying shares of common stock are not transferable other than by will or

the laws of descent and distribution, except as the Compensation Committee may permit.

Vesting of performance stock unit awards (‘‘PSUs’’) depends on (i) the Company’s achievement of a performance-based test

during a one-year period from the date of grant and during a three-year period from the date of grant, and (ii) assuming

achievement of the performance-based test, time vesting, subject, in general, to the executive remaining in the Company’s

service on specified vesting dates. Performance during the one-year period is based on Earnings Before Interest and Taxes

(‘‘EBIT’’) margin relative to a peer group of the Company comprising 50 companies. Upon achievement of the one-year

performance-based test, the corresponding PSUs will vest annually in substantially equal installments over a three year period

starting one year from the date of grant. Performance during the three-year period is based on Return on Invested Capital

(‘‘ROIC’’) relative to such peer group. Upon achievement of the three-year performance-based test, the corresponding PSUs

will vest on the fourth anniversary date of grant. The awards based on EBIT margin and ROIC are capped at 150% of target

achievement, with a floor of zero. PSUs are converted into shares of common stock upon payment following vesting.

BED BATH & BEYOND PROXY STATEMENT

68