Bed, Bath and Beyond 2014 Annual Report Download - page 12

Download and view the complete annual report

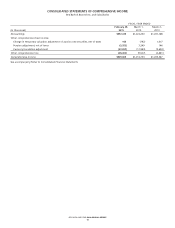

Please find page 12 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Potential volatility in the effective tax rate from year to year may occur as the Company is required each year to determine

whether new information changes the assessment of both the probability that a tax position will effectively be sustained and

the appropriateness of the amount of recognized benefit.

GROWTH

The Company is effecting its growth through the evolution of its omnichannel shopping environment, the optimization of its

store operations and market coverage by expanding, downsizing, renovating, opening, closing and relocating stores; the

growth of its complementary institutional business and the continuous review of strategic acquisitions.

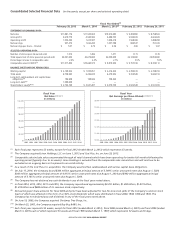

In the 23-year period from the beginning of fiscal 1992 to the end of fiscal 2014, the chain has grown from 34 to 1,513 stores

plus its various websites, other interactive platforms and distribution facilities. Total store square footage grew from

approximately 0.9 million square feet at the beginning of fiscal 1992 to approximately 43.0 million square feet at the end of

fiscal 2014. In addition, the Company has distribution facilities totaling 6.0 million square feet. During fiscal 2014, the

Company opened a total of 22 new stores and closed five stores. In fiscal 2014, consolidated store space, net of openings and

closings for all concepts, increased by 0.4 million square feet. Additionally, the Company is a partner in a joint venture which

opened one store during fiscal 2014 and as of February 28, 2015, operated a total of five retail stores in Mexico under the

name Bed Bath & Beyond.

The Company plans to continue to expand its operations and invest in its infrastructure to reach its long term objectives. In

fiscal 2015, the Company expects to open approximately 30 new stores company-wide and open a new customer service

contact center to support the anticipated growth across all channels and concepts and provide a seamless customer service

experience. Additionally, in connection with leveraging its merchandise offerings and optimizing its operations, the Company

continues to expand, across selected stores, the number of specialty departments such as health and beauty care, baby,

specialty food, and beverage. Also, the Company is committed to the continued growth of its merchandise categories and

channels and is growing the number of items it is able to have shipped directly to customers from a vendor. The continued

growth of the Company is dependent, in part, upon the Company’s ability to execute these items successfully.

Additionally, during fiscal 2015, the Company plans to add new functionality and assortment to its selling websites, mobile

sites and applications; continue the deployment of systems, equipment and increased bandwidth in its stores to develop a

more dynamic shopping experience and improve the productivity and working environment of its associates through

improvements in inventory ordering, optimizing work force management and lowering the Company’s shipping costs for

home deliveries; continue to strengthen and deepen its information technology, analytics, marketing and e-commerce groups;

improve customer data integration and customer relations management capabilities; further the development work necessary

for a new and more robust point of sale system; and open an additional distribution facility to support the growth of the

online direct to customer channel and health and beauty care offerings.

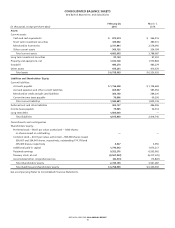

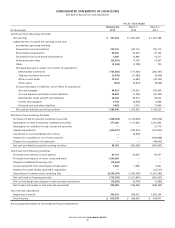

LIQUIDITY AND CAPITAL RESOURCES

The Company has been able to finance its operations, including its growth, through internally generated funds and

supplemented by borrowings through the Notes. For fiscal 2015, the Company believes that it can continue to finance its

operations, including its growth, share repurchases, planned capital expenditures and debt service obligations, through

existing and internally generated funds. In addition, if necessary, the Company could borrow under the Revolver. Capital

expenditures for fiscal 2015 are planned to be approximately $375 million to $400 million, with nearly half for information

technology enhancements, including omnichannel capabilities, and the remainder for new stores, existing store improvements,

and other projects. These planned capital expenditures are subject to the timing and composition of the projects. In addition,

the Company reviews its alternatives with respect to its capital structure on an ongoing basis.

On July 17, 2014, the Company issued the Notes. The aggregate net proceeds from the Notes were approximately $1.5 billion,

which was used for share repurchases of the Company’s common stock and for general corporate purposes. Interest on the

Notes is payable semi-annually on February 1 and August 1 of each year, beginning on February 1, 2015.

On July 17, 2014, the Company entered into an accelerated share repurchase agreement (‘‘ASR’’) with an investment bank to

repurchase an aggregate $1.1 billion of the Company’s common stock. The ASR was completed in December 2014. The total

number of shares repurchased under the ASR was 16.8 million shares at a weighted average share price of $65.41.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

BED BATH & BEYOND 2014 ANNUAL REPORT

10