Bed, Bath and Beyond 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

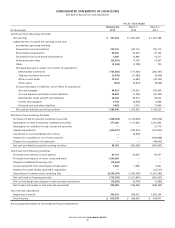

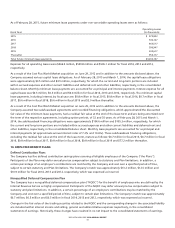

As of February 28, 2015, the Company’s financial assets utilizing Level 1 inputs include long term trading investment securities

traded on active securities exchanges. The Company did not have any financial assets utilizing Level 2 inputs. Financial assets

utilizing Level 3 inputs included long term investments in auction rate securities consisting of preferred shares of closed end

municipal bond funds (See ‘‘Investment Securities,’’ Note 4).

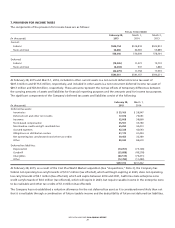

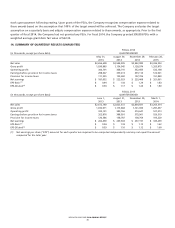

4. INVESTMENT SECURITIES

The Company’s investment securities as of February 28, 2015 and March 1, 2014 are as follows:

(in millions)

February 28,

2015

March 1,

2014

Available-for-sale securities:

Long term $ 47.9 $ 47.7

Trading securities:

Long term 49.2 39.7

Held-to-maturity securities:

Short term 110.0 489.3

Total investment securities $207.1 $576.7

Auction Rate Securities

As of February 28, 2015 and March 1, 2014, the Company’s available-for-sale investment securities represented approximately

$51.0 million par value of auction rate securities, consisting of preferred shares of closed end municipal bond funds, less

temporary valuation adjustments of approximately $3.1 million and $3.3 million, respectively. Since these valuation

adjustments are deemed to be temporary, they are recorded in accumulated other comprehensive loss, net of a related tax

benefit, and did not affect the Company’s net earnings.

U.S. Treasury Securities

As of February 28, 2015 and March 1, 2014, the Company’s short term held-to-maturity securities included approximately

$110.0 million and approximately $489.3 million, respectively, of U.S. Treasury Bills with remaining maturities of less than one

year. These securities are stated at their amortized cost which approximates fair value, which is based on quoted prices in

active markets for identical instruments (i.e., Level 1 valuation).

Long Term Trading Investment Securities

The Company’s long term trading investment securities, which are provided as investment options to the participants of the

nonqualified deferred compensation plan, are stated at fair market value. The values of these trading investment securities

included in the table above are approximately $49.2 million and $39.7 million as of February 28, 2015 and March 1, 2014,

respectively.

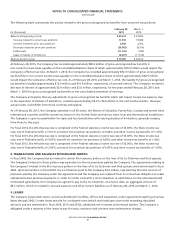

5. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

(in thousands)

February 28,

2015

March 1,

2014

Land and buildings $ 557,538 $ 538,422

Furniture, fixtures and equipment 1,179,073 1,120,330

Leasehold improvements 1,258,916 1,187,793

Computer equipment and software 940,754 755,867

3,936,281 3,602,412

Less: Accumulated depreciation (2,259,581) (2,022,608)

Property and equipment, net $ 1,676,700 $ 1,579,804

BED BATH & BEYOND 2014 ANNUAL REPORT

27