Bed, Bath and Beyond 2014 Annual Report Download - page 56

Download and view the complete annual report

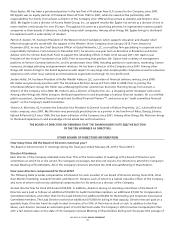

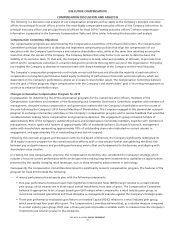

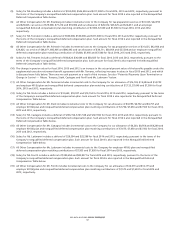

Please find page 56 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.— Awards of stock options, which are intended to be valued at no more than one-third of total performance-based equity,

and vest over a five-year period (three years for the Co-Chairmen). The Compensation Committee believed stock options

provide further incentives aligned with the long-term interests of shareholders.

— Awards of performance-based equity (in the form of performance stock units and stock options) which represents 79% of

the Chief Executive Officer’s cash and equity compensation for 2014, and the majority of cash and equity compensation

for the other named executive officers.

— No increase in base salary for the Company’s Chief Executive Officer or Co-Chairmen. The Company also maintained its

practice of not awarding cash bonuses.

In addition, the Board of Directors adopted the following:

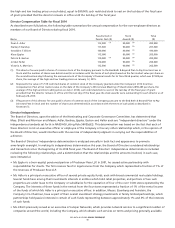

— Stock ownership guidelines that require the Company’s Chief Executive Officer and each outside director to hold the

Company’s common stock with a value of at least $6,000,000 and $300,000, respectively.

— Restrictions on engaging in hedging transactions involving the Company’s common stock and on pledging such common

stock, in each case, by the Company’s directors and executive officers.

The Compensation Committee believes that a combination of a performance metric requiring fiscal discipline in the relative

short term (one-year period) with a vesting period that extends over three years, and a performance metric that measures the

return on the investments being made to address a rapidly changing industry over a three-year period with vesting following

the fourth year, together with stock options vesting over three or five years, appropriately aligns the compensation program

with both the short- and long-term interests of the Company’s shareholders.

These changes are reflective of, and responsive to, the Company’s strategy (which balances the requirements of prudent

management in the relative short term with the necessity for significant investment focused on the longer term), shareholder

input, and the Compensation Committee’s objectives.

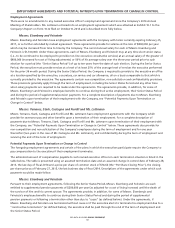

Methodology for Determining Executive Compensation

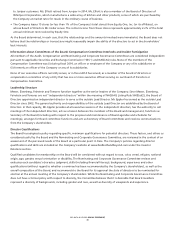

In making its determinations with respect to executive compensation, the Compensation Committee has engaged the services

of a compensation consultant pursuant to its charter. In connection with making its determinations regarding executive

compensation for fiscal 2014 and for several prior years, the Compensation Committee retained Arthur J. Gallagher & Co.

Human Resources & Compensation Consulting Practice (‘‘Gallagher’’) or its predecessor to conduct a compensation review for

the named executive officers and certain other executives. Gallagher has not served the Company in any other capacity except

as consultants to the Compensation Committee. Both the Compensation and the Nominating and Corporate Governance

Committees also receive advice and assistance from the law firm of Chadbourne & Parke LLP, which has acted as counsel only

to the Company’s independent directors and its Board committees. The Compensation Committee has assessed the

independence of Gallagher and Chadbourne & Parke LLP pursuant to the SEC rules and concluded that no conflict of interest

exists that will prevent them from being independent advisors to the Compensation Committee.

The Compensation Committee charter, which describes the Compensation Committee’s function, responsibilities and duties, is

available on the Company’s website at www.bedbathandbeyond.com under the Investor Relations section. The Compensation

Committee consists of three members of our Board of Directors: Ms. Morrison and Messrs. Adler and Barshay, all of whom are

‘‘independent’’ as defined by the NASDAQ listing standards and the applicable tax and securities rules and regulations. The

Compensation Committee meets on a regular basis for various reasons as outlined in its charter.

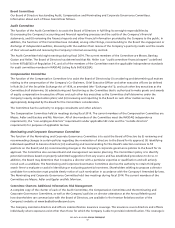

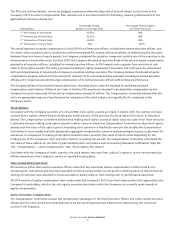

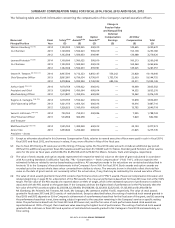

Under the direction of the Compensation Committee, the compensation review included a peer group competitive market

review of executive compensation and total compensation recommendations by Gallagher. The peer group developed by

Gallagher, agreed upon by the Compensation Committee and upon which it based its recommendations for fiscal 2014

compensation, consisted of 19 retail companies of a size range based on revenue and net income relatively closely aligned

with the Company’s revenue and net income, all of them in the retail industry.

The size of the peer group was reduced from the 23 companies used in fiscal 2013. Six companies were dropped from the peer

group on the recommendation of Gallagher for either one of two reasons: negative net income and severe financial stress or

revenue that was less than half of the Company’s revenue. These companies were Barnes & Noble, Inc., J.C. Penney Company, Inc.,

DSW Inc., Pier 1 Imports, Inc., Saks Incorporated, and Williams-Sonoma, Inc. Positive net income and comparable annual revenue

are two important factors in determining the Company’s peer group. Two companies were added — Dollar General Corporation

and Staples, Inc. — as their financial and business characteristics were compatible with the peer group design.

BED BATH & BEYOND PROXY STATEMENT

54