Bed, Bath and Beyond 2014 Annual Report Download - page 30

Download and view the complete annual report

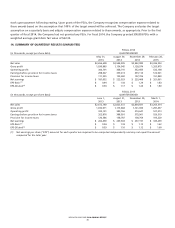

Please find page 30 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6. LONG TERM DEBT

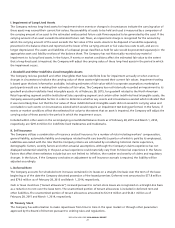

Senior Unsecured Notes

On July 17, 2014, the Company issued $300 million aggregate principal amount of 3.749% senior unsecured notes due

August 1, 2024 (the ‘‘2024 Notes’’), $300 million aggregate principal amount of 4.915% senior unsecured notes due August 1,

2034 (the ‘‘2034 Notes’’) and $900 million aggregate principal amount of 5.165% senior unsecured notes due August 1, 2044

(the ‘‘2044 Notes’’ and, together with the 2024 Notes and the 2034 Notes, the ‘‘Notes’’). The aggregate net proceeds from the

Notes were approximately $1.5 billion, which was used for share repurchases of the Company’s common stock and for general

corporate purposes. Interest on the Notes is payable semi-annually on February 1 and August 1 of each year, beginning on

February 1, 2015.

The Notes were issued under an indenture (the ‘‘Base Indenture’’), as supplemented by a first supplemental indenture

(together, with the Base Indenture, the ‘‘Indenture’’), which contains various restrictive covenants, which are subject to

important limitations and exceptions that are described in the Indenture. The Company was in compliance with all covenants

related to the Notes as of February 28, 2015.

The Notes are unsecured, senior obligations and rank equal in right of payment to any of the Company’s existing and future

senior unsecured indebtedness. The Company may redeem the Notes at any time, in whole or in part, at the redemption prices

described in the Indenture plus accrued and unpaid interest to the redemption date. If a change in control triggering event, as

defined by the Indenture governing the Notes, occurs unless the Company has exercised its right to redeem the Notes, the

Company will be required to make an offer to the holders of the Notes to purchase the Notes at 101% of their principal

amount, plus accrued and unpaid interest.

Revolving Credit Agreement

On August 6, 2014, the Company entered into a $250 million five year senior unsecured revolving credit facility agreement

(‘‘Revolver’’) with various lenders. During the period from August 6, 2014 through February 28, 2015, the Company did not

have any borrowings under the Revolver.

Borrowings under the Revolver accrue interest at either (1) a fluctuating rate equal to the greater of the prime rate, as defined

in the Revolver, the Federal Funds Rate plus 0.50%, or one-month LIBOR plus 1.0% and, in each case, plus an applicable margin

based upon the Company’s leverage ratio which is calculated quarterly, (2) a periodic fixed rate equal to LIBOR plus an

applicable margin based upon the Company’s leverage ratio which is calculated quarterly or (3) an agreed upon fixed rate. In

addition, a commitment fee is assessed, which is included in interest expense, net in the Consolidated Statement of Earnings.

The Revolver contains customary affirmative and negative covenants and also requires the Company to maintain a minimum

leverage ratio. The Company was in compliance with all covenants related to the Revolver as of February 28, 2015.

Deferred financing costs associated with the Notes and the Revolver of approximately $10.1 million were capitalized and are

included in other assets in the accompanying Consolidated Balance Sheets. These deferred financing costs are being amortized

over the term of each of the Notes and the term of the Revolver and such amortization is included in interest expense, net in

the Consolidated Statement of Earnings. Interest expense related to the Notes and the Revolver, including the commitment

fee and the amortization of the deferred financing costs, was approximately $44.9 million for the period from July 17, 2014

through February 28, 2015.

Lines of Credit

At February 28, 2015, the Company maintained two uncommitted lines of credit of $100 million each, with expiration dates of

September 1, 2015 and February 28, 2016, respectively. These uncommitted lines of credit are currently and are expected to be

used for letters of credit in the ordinary course of business. During fiscal 2014 and 2013, the Company did not have any direct

borrowings under the uncommitted lines of credit. As of February 28, 2015, there was approximately $11.1 million of

outstanding letters of credit. Although no assurances can be provided, the Company intends to renew both uncommitted lines

of credit before the respective expiration dates. In addition, as of February 28, 2015, the Company maintained unsecured

standby letters of credit of $71.7 million, primarily for certain insurance programs. As of March 1, 2014, there was

approximately $4.5 million of outstanding letters of credit and approximately $74.3 million of outstanding unsecured standby

letters of credit, primarily for certain insurance programs.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2014 ANNUAL REPORT

28