Bed, Bath and Beyond 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.W. Recent Accounting Pronouncements

In May 2014, Financial Accounting Standards Board issued Accounting Standards Update (‘‘ASU’’) 2014-09, Revenue from

Contracts with Customers. This guidance requires an entity to recognize revenue in a manner that depicts the transfer of

promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled

in exchange for those goods or services. The new standard also will result in enhanced disclosures about the nature, amount,

timing and uncertainty of revenue and cash flows arising from contracts with customers. ASU 2014-09 is effective for annual

reporting periods beginning after December 15, 2016, including interim periods within that reporting period, with earlier

adoption not permitted. ASU 2014-09 can be adopted either retrospectively to each prior reporting period presented or as a

cumulative-effect adjustment as of the date of adoption. The adoption of this guidance is not expected to have a significant

effect on our consolidated financial position, results of operations, or cash flows.

2. ACQUISITIONS

On June 1, 2012, the Company acquired Linen Holdings, LLC (‘‘Linen Holdings’’), a provider of a variety of textile products,

amenities and other goods to institutional customers in the hospitality, cruise line, healthcare and other industries, for an

aggregate purchase price of approximately $108.1 million. The purchase price includes approximately $24.0 million for

tradenames and approximately $40.2 million for goodwill. Linen Holdings is included within the Institutional Sales operating

segment. In the first quarter of fiscal 2013, the Company finalized the valuation of assets acquired and liabilities assumed.

Since the date of acquisition, the results of Linen Holdings’ operations, which are not material, have been included in the

Company’s results of operations.

On June 29, 2012, the Company acquired Cost Plus, Inc. (‘‘Cost Plus World Market’’), a retailer selling a wide range of home

decorating items, furniture, gifts, holiday and other seasonal items, and specialty food and beverages, for an aggregate

purchase price of approximately $560.5 million, including the payment of assumed borrowings of $25.5 million under a credit

facility. The acquisition was consummated by a wholly owned subsidiary of the Company through a tender offer and merger,

pursuant to which the Company acquired all of the outstanding shares of common stock of Cost Plus World Market. Cost Plus

World Market is included within the North American Retail operating segment. In the first quarter of fiscal 2013, the Company

finalized the valuation of assets acquired and liabilities assumed.

Since the date of acquisition, the results of Cost Plus World Market’s operations, which are not material, have been included in

the Company’s results of operations and no proforma disclosure of financial information has been presented.

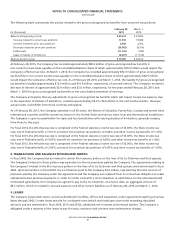

3. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., ‘‘the exit price’’) in an

orderly transaction between market participants at the measurement date. In determining fair value, the Company uses

various valuation approaches, including quoted market prices and discounted cash flows. The hierarchy for inputs used in

measuring fair value maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that

the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing

the asset or liability developed based on market data obtained from independent sources. Unobservable inputs are inputs that

reflect a company’s judgment concerning the assumptions that market participants would use in pricing the asset or liability

developed based on the best information available under the circumstances. In certain cases, the inputs used to measure fair

value may fall into different levels of the fair value hierarchy. In such cases, an asset or liability must be classified in its entirety

based on the lowest level of input that is significant to the measurement of fair value. The fair value hierarchy is broken down

into three levels based on the reliability of inputs as follows:

• Level1—Valuations based on quoted prices in active markets for identical instruments that the Company is able to

access. Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation

of these products does not entail a significant degree of judgment.

• Level2—Valuations based on quoted prices in active markets for instruments that are similar, or quoted prices in markets

that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

• Level3—Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2014 ANNUAL REPORT

26