Bed, Bath and Beyond 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

matched by the Company, subject to certain limitations. This matching contribution will vest over a specified period of time.

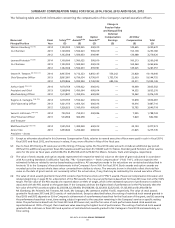

See the ‘‘Nonqualified Deferred Compensation Table’’ below.

The Company provides the named executive officers with certain perquisites including tax preparation services and car service,

in the case of Messrs. Eisenberg and Feinstein, and a car allowance, in the case of all named executive officers, other than Ms.

Lattmann. The Compensation Committee believes all such perquisites are reasonable and consistent with its overall objective

of attracting and retaining our named executive officers.

See the ‘‘All Other Compensation’’ column in the Summary Compensation Table for further information regarding these

benefits and perquisites, and ‘‘Potential Payments Upon Termination or Change in Control’’ below for information regarding

termination and change in control payments and benefits.

Other Executive Officer and Director Governance Matters

As a result of the 2014 outreach to and engagement with the Company’s shareholders described above and other feedback,

the following governance initiatives were adopted in 2014:

Annual Board and Committee Self-Assessments — The Board of Directors adopted a policy under which the Company’s Board

of Directors and its committees conduct a formal self-assessment at least annually.

Limits on Other Board Service — The Board of Directors adopted a policy limiting service by the Company’s directors on other

public company boards of directors to no more than two other directorships (in the case of the Company’s Co-Chairmen and

Chief Executive Officer) and four other directorships (in the case of the non-executive directors).

Impact of Accounting and Tax Considerations

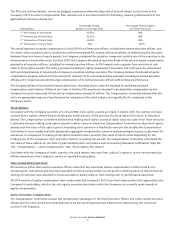

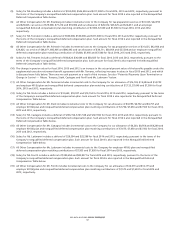

The Compensation Committee considers the accounting cost associated with equity compensation and the impact of Section

162(m) of the Code, which generally prohibits any publicly held corporation from taking a federal income tax deduction for

compensation paid in excess of $1 million in any taxable year to certain executives, subject to certain exceptions for

performance-based compensation. Stock options and performance-based compensation granted to our named executive

officers are intended to satisfy the performance-based exception and be deductible. Base salary amounts in excess of $1

million are not deductible by the Company.

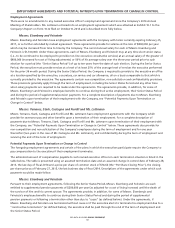

Policy on the Recovery of Incentive Compensation

In fiscal 2009, the Board adopted a policy as part of the Company’s corporate governance guidelines on the recovery of

incentive compensation, commonly referred to as a ‘‘clawback policy,’’ applicable to the Company’s named executive officers

(as defined under Item 402(a)(3) of Regulation S-K). The policy appears in the Company’s Corporate Governance Guidelines,

available in the Investor Relations section of the Company’s website at www.bedbathandbeyond.com. The Compensation

Committee is monitoring the issuance of regulations under the Dodd-Frank Wall Street Reform and Consumer Protection Act

relating to incentive compensation recoupment and will amend its policy to the extent necessary to comply with such Act.

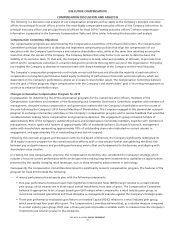

2014 Advisory Vote Result and Continued Engagement

While the redesigned equity incentive compensation program and governance changes for fiscal 2014 had been announced

prior to the Annual Meeting of Shareholders in July 2014, shareholders were asked to approve the compensation for our

named executive officers for the fiscal year ended March 1, 2014, for which period the former, unrevised performance

program was in place. Approximately 72% of the shares voted on the say-on-pay proposal for that fiscal year approved the

proposal.

Since July 2014, members of the Company’s management and Board committees have continued active engagement with

shareholders on various governance and compensation matters. The Company has initiated outreach to approximately 61% of

the outstanding shares and met with or spoke to shareholders representing approximately 40% of the Company’s outstanding

shares. The policies described and disclosures made in this Compensation Discussion & Analysis reflect, in part, feedback

resulting from this ongoing shareholder engagement.

Conclusion

After careful review and analysis, the Company believes that each element of compensation and the total compensation

provided to each of its named executive officers for fiscal 2014 was reasonable and appropriate. The value of the

compensation payable to the named executive officers is significantly tied to the Company’s performance and the return to its

shareholders over time. The Company believes that its compensation programs will allow it to retain the executives who are

part of the Company’s executive team and attract highly qualified executives when new executives are required.

BED BATH & BEYOND PROXY STATEMENT

59