Bed, Bath and Beyond 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Incentive Compensation Plans

The Company currently grants awards under the Bed Bath & Beyond 2012 Incentive Compensation Plan (the ‘‘2012 Plan’’),

which amended and restated the Bed Bath & Beyond 2004 Incentive Compensation Plan (the ‘‘2004 Plan’’). The 2012 Plan

includes an aggregate of 43.2 million common shares authorized for issuance and the ability to grant incentive stock options.

Outstanding awards that were covered by the 2004 Plan continue to be in effect under the 2012 Plan.

The 2012 Plan is a flexible compensation plan that enables the Company to offer incentive compensation through stock

options (whether nonqualified stock options or incentive stock options), restricted stock awards, stock appreciation rights,

performance awards and other stock based awards, including cash awards. Under the 2012 Plan, grants are determined by the

Compensation Committee for those awards granted to executive officers and by an appropriate committee for all other

awards granted. Awards of stock options and restricted stock generally vest in five equal annual installments beginning one to

three years from the date of grant. Awards of performance share units generally vest over a period of four years from the date

of grant dependent on the Company’s achievement of performance-based tests and subject, in general, to the executive

remaining in the Company’s service on specified vesting dates.

The Company generally issues new shares for stock option exercises, restricted stock awards and vesting of performance

share units. As of February 28, 2015, unrecognized compensation expense related to the unvested portion of the Company’s

stock options, restricted stock awards and performance share units was $24.8 million, $127.3 million and $15.1 million,

respectively, which is expected to be recognized over a weighted average period of 2.6 years, 3.5 years and 2.5 years,

respectively.

Stock Options

Stock option grants are issued at fair market value on the date of grant and generally become exercisable in either three or

five equal annual installments beginning one year from the date of grant for options issued since May 10, 2010, and beginning

one to three years from the date of grant for options issued prior to May 10, 2010, in each case, subject, in general to the

recipient remaining in the Company’s service on specified vesting dates. Option grants expire eight years after the date of

grant for stock options issued since May 10, 2004, and expire ten years after the date of grant for stock options issued prior to

May 10, 2004. All option grants are nonqualified.

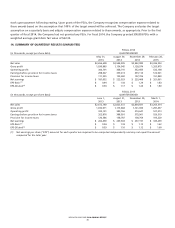

The fair value of the stock options granted was estimated on the date of the grant using a Black-Scholes option-pricing model

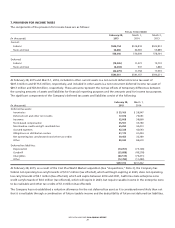

that uses the assumptions noted in the following table.

FISCAL YEAR ENDED

Black-Scholes Valuation Assumptions

(1)

February 28,

2015

March 1,

2014

March 2,

2013

Weighted Average Expected Life (in years)

(2)

6.6 6.6 6.5

Weighted Average Expected Volatility

(3)

28.31% 29.27% 31.07%

Weighted Average Risk Free Interest Rates

(4)

2.11% 1.11% 1.14%

Expected Dividend Yield ———

(1) Forfeitures are estimated based on historical experience.

(2) The expected life of stock options is estimated based on historical experience.

(3) Expected volatility is based on the average of historical and implied volatility. The historical volatility is determined by observing actual

prices of the Company’s stock over a period commensurate with the expected life of the awards. The implied volatility represents the

implied volatility of the Company’s call options, which are actively traded on multiple exchanges, had remaining maturities in excess of

twelve months, had market prices close to the exercise prices of the employee stock options and were measured on the stock option

grant date.

(4) Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options.

BED BATH & BEYOND 2014 ANNUAL REPORT

33