Bed, Bath and Beyond 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

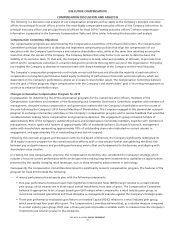

In the spring of 2014, when the Compensation Committee made its determinations relating to executive compensation for the

Company’s named executive officers for fiscal 2014, the Compensation Committee took into account, among other things, the

following:

• the Company’s net earnings per diluted share had increased to $4.79 for fiscal 2013 from $4.56 in the prior year;

• the Company had returned approximately $1.284 billion to shareholders through share repurchases in fiscal year 2013; and

• the Company had made capital expenditures exceeding $300 million in fiscal 2013, including principally for the Company’s

omnichannel expansion, and operated approximately 1,500 stores.

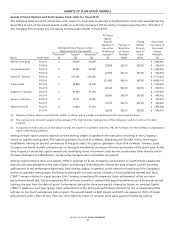

For fiscal 2014, Chief Executive Officer Steven Temares’ total compensation, as presented in the Summary Compensation Table,

decreased slightly when compared to fiscal 2013, with a shift in the mix of compensation components toward performance-

based equity. Mr. Temares did not receive an increase in his base salary from fiscal 2013 to 2014, which remained at $3,967,500,

and which represented his entire cash compensation since the Company does not pay cash bonuses. Cash compensation for

fiscal 2014 represented 21% of Mr. Temares’ total compensation.

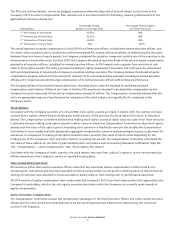

Equity awards to Mr. Temares for fiscal 2014 consisted of $9,712,323 of PSUs (representing 155,796 PSUs) and $4,856,147 of

stock options (representing 231,682 options). Approximately 79% of Mr. Temares’ cash and equity compensation for fiscal 2014

was dependent on Company performance and/or an increase in shareholder value.

The Board also adopted stock ownership guidelines for the Company’s Chief Executive Officer in 2014 requiring the Chief

Executive Officer to hold Company stock with a value of at least $6,000,000. The Compensation Committee noted that this

amount in total dollar value was commensurate with the chief executive officer ownership requirement compared to the

Company’s peer group. As of May 6, 2015, Mr. Temares held approximately $39.4 million in stock, which is well in excess of the

minimum $6,000,000 requirement.

For fiscal 2014, the base salaries for the Co-Chairmen did not increase and remained at $1,100,000 each, the same as they were

for the previous eight years. Equity awards in 2014 for the Co-Chairmen did not increase and have remained in the same

amount as they were for the previous three years (rounded to the next full share). The base salaries and equity awards of the

other named executive officers increased based upon several factors including increased responsibilities and individual

performance.

The stock options granted to the Chief Executive Officer and the other named executive officers vest in five equal annual

installments, while the stock options awarded to the Co-Chairmen vest in three equal annual installments. In each case, vesting

commences on the first anniversary of the grant date and is also based on continued service to the Company.

In the view of the Compensation Committee, the fiscal 2014 compensation packages for the Chief Executive Officer and for

the Co-Chairmen, as well as the other named executive officers, based on the Company’s growth and strong financial results in

2013 and based on the results and recommendations of Gallagher’s compensation review, were appropriate for a company

with the revenues and earnings of the Company.

For further discussion related to equity grants to the named executive officers in fiscal 2014, see ‘‘Potential Payments Upon

Termination or Change in Control’’ below.

Fiscal 2015 Chief Executive Officer Compensation

Consistent with 2014, the Compensation Committee did not increase the Chief Executive Officer’s base salary in 2015 with such

officer receiving only an increase in 2015 equity compensation that was in line with the increase in total compensation for

other members of senior management if performance targets are met. This represents two consecutive years with no increase

in cash compensation.

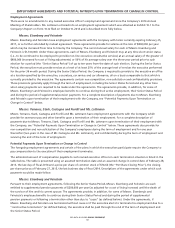

Other Benefits

The Company provides the named executive officers with the same benefits offered to all other associates. The cost of these

benefits constitutes a small percentage of each named executive officer’s total compensation. Key benefits include paid

vacation, premiums paid for long-term disability insurance, a matching contribution to the named executive officer’s 401(k)

plan account, and the payment of a portion of the named executive officer’s premiums for healthcare and basic life insurance.

The Company has a nonqualified deferred compensation plan for the benefit of certain highly compensated associates,

including the named executive officers. The plan provides that a certain percentage of an associate’s contributions may be

BED BATH & BEYOND PROXY STATEMENT

58