Bed, Bath and Beyond 2014 Annual Report Download - page 27

Download and view the complete annual report

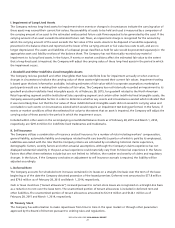

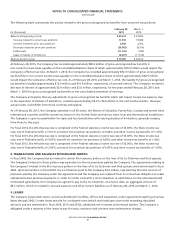

Please find page 27 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.R. Store Opening, Expansion, Relocation and Closing Costs

Store opening, expansion, relocation and closing costs, including markdowns, asset residual values and projected occupancy

costs, are charged to earnings as incurred.

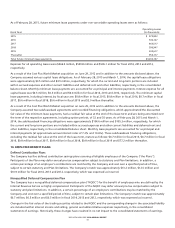

S. Advertising Costs

Expenses associated with direct response advertising are expensed over the period during which the sales are expected to

occur, generally four to seven weeks, and all other expenses associated with store advertising are charged to earnings as

incurred. Net advertising costs amounted to $308.4 million, $280.5 million and $250.6 million for fiscal 2014, 2013 and 2012,

respectively.

T. Stock-Based Compensation

The Company measures all employee stock-based compensation awards using a fair value method and records such expense in

its consolidated financial statements. The Company adopted the accounting guidance related to stock compensation on

August 28, 2005 (the ‘‘date of adoption’’) under the modified prospective application. Under this application, the Company

records stock-based compensation expense for all awards granted on or after the date of adoption and for the portion of

previously granted awards that remained unvested at the date of adoption. Currently, the Company’s stock-based

compensation relates to restricted stock awards, stock options and performance share units. The Company’s restricted stock

awards are considered nonvested share awards.

U. Income Taxes

The Company files a consolidated Federal income tax return. Income tax returns are also filed with each taxable jurisdiction in

which the Company conducts business.

The Company accounts for its income taxes using the asset and liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to the differences between the financial statement carrying amounts

of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax

assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the year in which those

temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in

tax rates is recognized in earnings in the period that includes the enactment date.

The Company intends to reinvest the unremitted earnings of its Canadian subsidiary. Accordingly, no provision has been made

for U.S. or additional non-U.S. taxes with respect to these earnings. In the event of repatriation to the U.S., in most cases such

earnings would be subject to U.S. income taxes.

The Company recognizes the tax benefit from an uncertain tax position only if it is at least more likely than not that the tax

position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax

benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a

greater than fifty percent likelihood of being realized upon settlement with the taxing authorities.

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In

the ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain.

Additionally, the Company’s tax returns are subject to audit by various tax authorities. Although the Company believes that its

estimates are reasonable, actual results could differ from these estimates.

V. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been computed by

dividing net earnings by the weighted average number of shares outstanding including the dilutive effect of stock-based

awards as calculated under the treasury stock method.

Stock-based awards of approximately 1.7 million, 1.2 million and 1.2 million shares were excluded from the computation of

diluted earnings per share as the effect would be anti-dilutive for fiscal 2014, 2013 and 2012, respectively.

BED BATH & BEYOND 2014 ANNUAL REPORT

25