Bed, Bath and Beyond 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

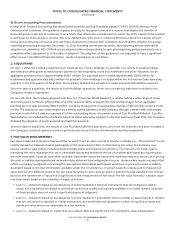

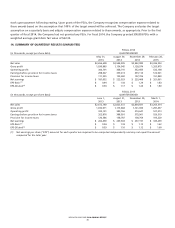

Changes in the Company’s stock options for the fiscal year ended February 28, 2015 were as follows:

(Shares in thousands)

Number of

Stock Options

Weighted Average

Exercise Price

Options outstanding, beginning of period 4,192 $46.85

Granted 523 62.34

Exercised (1,033) 39.73

Forfeited or expired ——

Options outstanding, end of period 3,682 $51.05

Options exercisable, end of period 1,989 $42.69

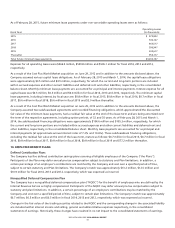

The weighted average fair value for the stock options granted in fiscal 2014, 2013 and 2012 was $20.96, $22.28 and $22.95,

respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding as of

February 28, 2015 was 4.1 years and $87.2 million, respectively. The weighted average remaining contractual term and the

aggregate intrinsic value for options exercisable as of February 28, 2015 was 2.9 years and $63.6 million, respectively. The total

intrinsic value for stock options exercised during fiscal 2014, 2013 and 2012 was $33.5 million, $44.6 million and $38.8 million,

respectively.

Net cash proceeds from the exercise of stock options for fiscal 2014 were $41.2 million and the net associated income tax

benefit was $13.9 million.

Restricted Stock

Restricted stock awards are issued and measured at fair market value on the date of grant and generally become vested in five

equal annual installments beginning one to three years from the date of grant, subject, in general, to the recipient remaining

in the Company’s service on specified vesting dates. Vesting of restricted stock awarded to certain of the Company’s executives

is dependent on the Company’s achievement of a performance-based test for the fiscal year of grant and, assuming

achievement of the performance-based test, time vesting, subject, in general, to the executive remaining in the Company’s

service on specified vesting dates. The Company recognizes compensation expense related to these awards based on the

assumption that the performance-based test will be achieved. Vesting of restricted stock awarded to the Company’s other

employees is based solely on time vesting.

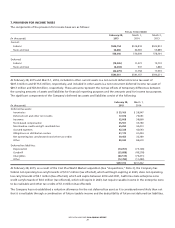

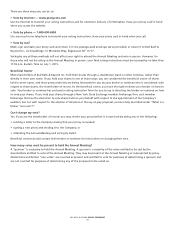

Changes in the Company’s restricted stock for the fiscal year ended February 28, 2015 were as follows:

(Shares in thousands)

Number of

Restricted Shares

Weighted Average

Grant-Date

Fair Value

Unvested restricted stock, beginning of period 3,943 $53.66

Granted 852 62.72

Vested (1,042) 45.36

Forfeited (161) 60.68

Unvested restricted stock, end of period 3,592 $57.90

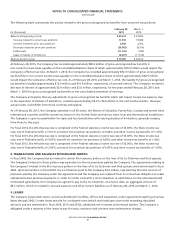

Performance Share Units

Performance share units (‘‘PSUs’’) are issued and measured at fair market value on the date of grant. Vesting of PSUs awarded

to certain of the Company’s executives is dependent on the Company’s achievement of a performance-based test during a

one-year period from the date of grant and during a three-year period from the date of grant and, assuming achievement of

the performance-based test, time vesting, subject, in general, to the executive remaining in the Company’s service on specified

vesting dates. Performance during the one-year period will be based on Earnings Before Interest and Taxes (‘‘EBIT’’) margin

relative to a peer group of the Company comprising 50 companies selected within the first 90 days of the performance period.

Upon achievement of the one-year performance-based test, the corresponding PSUs will vest annually in substantially equal

installments over a three year period starting one year from the date of grant. Performance during the three-year period will

be based on Return on Invested Capital (‘‘ROIC’’) relative to such peer group. Upon achievement of the three-year

performance-based test, the corresponding PSUs will vest on the fourth anniversary date of grant. The awards based on EBIT

margin and ROIC are capped at 150% of target achievement, with a floor of zero. PSUs are converted into shares of common

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2014 ANNUAL REPORT

34