Bed, Bath and Beyond 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the high and low trading prices on such date), equal to $90,000, such restricted stock to vest on the last day of the fiscal year

of grant provided that the director remains in office until the last day of the fiscal year.

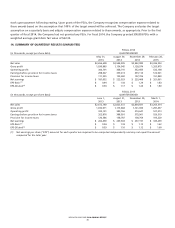

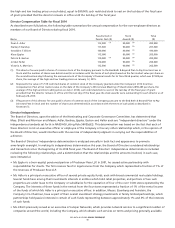

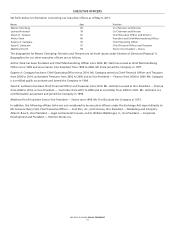

Director Compensation Table for Fiscal 2014

As described more fully below, the following table summarizes the annual compensation for the non-employee directors as

members of our Board of Directors during fiscal 2014.

Name

Fees Earned or

Paid in Cash ($)

Stock

Awards ($)

Total

($)

Dean S. Adler 112,500

(1)

90,000

(2)

202,500

Stanley F. Barshay 117,500 90,000

(2)

207,500

Geraldine T. Elliott 100,000 90,000

(2)

190,000

Klaus Eppler 115,000 90,000

(2)

205,000

Patrick R. Gaston 110,000

(3)

90,000

(2)

200,000

Jordan Heller 110,000 90,000

(2)

200,000

Victoria A. Morrison 112,500 90,000

(2)

202,500

(1) This director fee was paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay Directors Fees in

Stock and the number of shares was determined (in accordance with the terms of such plan) based on the fair market value per share on

the second business day following the announcement of the Company’s financial results for its fiscal third quarter, which was $73.89 per

share, the average of the high and low trading prices on January 12, 2015.

(2) Represents the value of 1,519 restricted shares of common stock of the Company granted under the Company’s 2012 Incentive

Compensation Plan at fair market value on the date of the Company’s 2014 Annual Meeting of Shareholders ($59.285 per share, the

average of the high and low trading prices on July 7, 2014), such restricted stock to vest on the last day of the fiscal year of grant

provided that the director remains in office until the last day of the fiscal year. No stock awards were outstanding for each director as of

February 28, 2015.

(3) Fifty percent of this director fee was paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay

Directors Fees in Stock and the number of shares was determined (in accordance with the terms of such plan) as described in

footnote (1).

Director Independence

The Board of Directors, upon the advice of the Nominating and Corporate Governance Committee, has determined that

Mses. Elliott and Morrison and Messrs. Adler, Barshay, Eppler, Gaston and Heller each are ‘‘independent directors’’ under the

independence standards set forth in NASDAQ Listing Rule 5605(a)(2). This determination was based on the fact that each of

these directors is not an executive officer or employee of the Company or has any other relationship which, in the opinion of

the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of

a director.

The Board of Directors’ independence determination is analyzed annually in both fact and appearance to promote

arms-length oversight. In making its independence determination this year, the Board of Directors considered relationships

and transactions since the beginning of its 2014 fiscal year. The Board of Directors’ independence determinations included

reviewing the following relationships, and a determination that the relationships and the amounts involved, in each case,

were immaterial.

• Mr. Eppler is a (non-equity) pensioned partner of Proskauer Rose LLP. In 2001, he ceased active partnership with

responsibilities for clients. The firm receives fees for legal services from the Company which represented a fraction of 1% of

the revenues of Proskauer Rose LLP.

• Mr. Adler is a principal or executive officer of several private equity funds, each with broad commercial real estate holdings.

Several funds have among their investments interests in entities which hold retail properties, and portions of two such

properties are under lease to the Company or subsidiaries for the operation of four of the over 1,500 stores operated by the

Company. The interests of these funds in the rentals from the four stores represented a fraction of 1% of the rental income

of the funds of which Mr. Adler is a principal or executive officer. In addition, Messrs. Eisenberg and Feinstein, the

Company’s Co-Chairmen, have as part of their overall investment strategy investments in family limited partnerships, which

partnerships hold passive interests in certain of such funds representing between approximately 1% and 3% of the interests

of such funds.

• Ms. Elliott previously served as an executive of Juniper Networks, which provides network services to a significant number of

companies around the world, including the Company, which obtains such services on terms and pricing generally available

BED BATH & BEYOND PROXY STATEMENT

45