Bed, Bath and Beyond 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

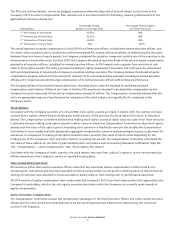

The PSUs are not transferable, cannot be pledged, assigned or otherwise disposed of and are subject to the terms of the

Company’s 2012 Incentive Compensation Plan. Awards vest in accordance with the following, assuming achievement of the

applicable performance-based test:

Vesting Date

Percentage Vested

Subject to One-Year Goal

Percentage Vested Subject

to Three-Year Goal

1

st

Anniversary of Grant Date 33.33% N/A

2

nd

Anniversary of Grant Date 33.33% N/A

3

rd

Anniversary of Grant Date 33.34% N/A

4

th

Anniversary of Grant Date N/A 100%

The overall approach to equity compensation in fiscal 2014 for all executive officers, including the named executive officers, and

for certain other executives was to combine the performance-based PSU awards with stock options. In determining the allocation

between these two forms of equity awards, the Company considered the retention component and the role of the executive in the

enhancement of shareholder value. For fiscal 2014, the Company allocated at least two-thirds of the value of equity compensation

granted to all executive officers, including the named executive officers, to PSU awards and no greater than one-third of such

value to stock option awards. The vesting provisions relating to equity compensation have been and continue to be determined

with a principal purpose of retaining the Company’s executives and key associates. The Company believes its redesigned equity

compensation program will promote the long-term retention of its executives and key associates including its named executive

officers and in large measure directly align compensation of its named executive officers with Company performance.

The Company believes that the performance-based tests, described above, meet the standard for performance-based

compensation under Section 162(m) of the Code, so that the PSU awards are intended to be deductible compensation by the

Company for certain executives if their annual compensation exceeds $1 million. The Compensation Committee believes that this

test is an appropriate measure of performance for companies in the retail industry and, specifically, for companies in the

Company’s sector.

Stock Options

Consistent with the Company’s practice since fiscal 2008, stock option awards are made in dollars (with the number of shares

covered by the options determined by dividing the dollar amount of the grant by the Stock Option Fair Value, as described

below). The Compensation Committee believes that making stock option awards in dollar amounts rather than share amounts

is advisable because making stock option awards in dollar amounts allows the Compensation Committee to align stock option

awards with the value of the option grants. Awarding stock options in a fixed dollar amount also enables the Compensation

Committee to more readily evaluate appropriate aggregate compensation amounts and percentage increases or decreases for

executives, in comparison to making stock option awards in share amounts (the value of which varies depending on the

trading price of the Company’s stock and other factors). In making the awards, the Compensation Committee considered the

fair value of these options on the date of grant determined in accordance with Accounting Standards Codification Topic No.

718, ‘‘Compensation — Stock Compensation’’ (the ‘‘Stock Option Fair Value’’).

Consistent with the Company’s historic practice, the stock options vest over time, subject, in general, to the named executive

officers remaining in the Company’s service on specified vesting dates.

Time Vested Restricted Stock

All executives (other than named executive officers and other key executives whose compensation is determined by the

Compensation Committee) and associates awarded incentive compensation receive grants consisting solely of restricted stock.

Vesting of restricted stock awarded to these associates is based solely on time vesting with no performance-based test.

All 2014 awards of equity compensation were made under the Company’s 2012 Incentive Compensation Plan approved by the

Company’s shareholders, which is the only equity incentive plan under which the Company can currently make awards of

equity compensation.

Senior Executive Compensation

The Compensation Committee reviews the compensation packages for the Chief Executive Officer, the other named executive

officers and the other senior executives believed to be the most important and influential in determining the continued

success of the Company.

BED BATH & BEYOND PROXY STATEMENT

57