Avon 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 16. Goodwill and Intangible

Assets

In August 2006, we purchased all of the remaining 6.155%

outstanding shares in our two joint venture subsidiaries in China

from the minority interest shareholders for approximately $39.1.

We previously owned 93.845% of these subsidiaries and con-

solidated their results, while recording minority interest for the

portion not owned. Upon completion of the transaction, we

eliminated the minority interest in the net assets of these sub-

sidiaries. The purchase of these shares did not have a material

impact on our consolidated net income. Avon China is a stand-

alone operating segment. The purchase price allocation resulted

in goodwill of $33.3 and customer relationships of $1.9 with a

ten-year weighted-average useful life.

On October 18, 2005, we purchased the Avon direct-selling

business of our licensee in Colombia for approximately $154.0 in

cash, pursuant to a share purchase agreement that Avon

International Holdings Company, a wholly-owned subsidiary of

the Company, entered into with Sarastro Ltd. Ldc. on October 7,

2005. The acquired business is being operated by a new wholly-

owned subsidiary under the name “Avon Colombia” and is

included in our Latin America operating segment. We had a

pre-existing license arrangement with the acquired business. The

negotiated terms of the license agreement were considered to

be at market rates; therefore, no settlement gain or loss was

recognized upon acquisition. During the fourth quarter of 2005,

we recorded a preliminary purchase price allocation, which

resulted in goodwill of $94.8, licensing agreement of $32.0

(four-year useful life), customer relationships of $35.1 (seven-

year weighted-average useful life), and a noncompete agree-

ment of $3.9 (three-year useful life). During 2006, we gathered

additional data to refine certain assumptions of the valuation.

The revised purchase price allocation resulted in goodwill of

$94.6, licensing agreement of $36.0 (four-year useful life), cus-

tomer relationships of $28.6 (five-year weighted-average useful

life), and a noncompete agreement of $3.9 (three-year useful

life).

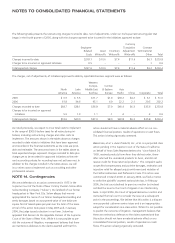

Goodwill

Latin

America

Western

Europe,

Middle

East &

Africa

Central

& Eastern

Europe

Asia

Pacific China Total

Balance at December 31, 2005 $95.7 $24.6 $8.7 $10.1 $32.5 $171.6

Goodwill acquired – – – – 33.3 33.3

Impairment loss (.7) (.7)

Adjustments (.2) – – – – (.2)

Foreign exchange .3 (.4) .1 .1 (.4) (.3)

Balance at December 31, 2006 $95.1 $24.2 $8.8 $10.2 $65.4 $203.7

The impairment losses relate to the write-off of goodwill associated with the closure of unprofitable operations in Asia Pacific as a result of

the implementation of certain restructuring initiatives (see Note 13, Restructuring Initiatives).

A V O N 2006 F-31