Avon 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

entitled Nilesh Patel v. Avon Products, Inc. et al. and Michael

Cascio v. Avon Products, Inc. et al., respectively, which sub-

sequently have been consolidated. A consolidated amended

class action complaint for alleged violations of the federal secu-

rities laws was filed in the consolidated action in December 2005

in the United States District Court for the Southern District of

New York (Master File Number 05-CV-06803) under the caption

In re Avon Products, Inc. Securities Litigation naming Avon, an

officer and two officer/directors. The consolidated action,

brought on behalf of purchasers of our common stock between

February 3, 2004 and September 20, 2005, seeks damages for

alleged false and misleading statements “concerning Avon’s

operations and performance in China, the United States ...and

Mexico.” The consolidated amended complaint also asserts that

during the class period certain officers and directors sold shares

of our common stock. In February 2006, we filed a motion to

dismiss the consolidated amended class action complaint, assert-

ing, among other things, that it failed to state a claim upon

which relief may be granted, and the plaintiffs have opposed

that motion.

In August 2005, we reported the filing of a complaint in a share-

holder derivative action purportedly brought on behalf of Avon

entitled Robert L. Garber, derivatively on behalf of Avon Prod-

ucts, Inc. v. Andrea Jung et al. as defendants, and Avon Prod-

ucts, Inc. as nominal defendant. An amended complaint was

filed in this action in December 2005 in the United States District

Court for the Southern District of New York (Master File Number

05-CV-06803) under the caption In re Avon Products, Inc. Secu-

rities Litigation naming certain of our officers and directors. The

amended complaint alleges that defendants’ violations of state

law, including breaches of fiduciary duties, abuse of control,

gross mismanagement, waste of corporate assets and unjust

enrichment, between February 2004 and the present, have

caused losses to Avon. In February 2006, we filed a motion to

dismiss the amended complaint, asserting, among other things,

that it failed to state a claim upon which relief may be granted,

and the plaintiffs have opposed that motion.

In October 2005, we reported the filing of class action com-

plaints for alleged violations of the Employee Retirement Income

Security Act (“ERISA”) in actions entitled John Rogati v. Andrea

Jung, et al. and Carolyn Jane Perry v. Andrea Jung, et al.,

respectively, which subsequently have been consolidated. A

consolidated class action complaint for alleged violations of

ERISA was filed in the consolidated action in December 2005 in

the United States District Court for the Southern District of New

York (Master File Number 05-CV-06803) under the caption In re

Avon Products, Inc. ERISA Litigation naming Avon, certain offi-

cers, Avon’s Retirement Board and others. The consolidated

action purports to be brought on behalf of the Avon Products,

Inc. Personal Savings Account Plan and the Avon Products, Inc.

Personal Retirement Account Plan (collectively the “Plan”) and

on behalf of participants and beneficiaries of the Plan “for

whose individual accounts the Plan purchased or held an interest

in Avon Products, Inc. . . . common stock from February 20,

2004 to the present.” The consolidated complaint asserts

breaches of fiduciary duties and prohibited transactions in viola-

tion of ERISA arising out of, inter alia, alleged false and mislead-

ing public statements regarding Avon’s business made during

the class period and investments in Avon stock by the Plan and

Plan participants. In February 2006, we filed a motion to dismiss

the consolidated complaint, asserting that it failed to state a

claim upon which relief may be granted, and the plaintiffs have

opposed that motion.

It is not possible to predict the outcome of litigation and it is

reasonably possible that there could be unfavorable outcomes in

the In re Avon Products, Inc. Securities Litigation, In re Avon

Products, Inc. Securities Litigation (derivative action) and In re

Avon Products, Inc. ERISA Litigation matters. Management is

unable to make a meaningful estimate of the amount or range

of loss that could result from unfavorable outcomes but, under

some circumstances, adverse awards could be material to our

consolidated financial position, results of operations or cash

flows.

Various other lawsuits and claims, arising in the ordinary course

of business or related to businesses previously sold, are pending

or threatened against Avon. In management’s opinion, based on

its review of the information available at this time, the total cost

of resolving such other contingencies at December 31, 2006,

should not have a material adverse effect on our consolidated

financial position, results of operations or cash flows.

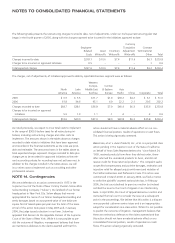

NOTE 15. Supplemental Income

Statement Information

For the years ended December 31, 2006, 2005 and 2004, the

components of other expense, net were as follows:

2006 2005 2004

Foreign exchange losses, net $ 6.2 $ 5.8 $ 9.5

Net (gains) losses on available-for-sale

securities (Note 5) – (2.5) 13.7

Amortization of debt issue costs and

other financing 9.6 8.9 7.0

Gain on de-designated treasury lock

agreement (Note 7) – (2.5) –

Other (2.2) (1.7) (1.9)

Other expense, net $13.6 $ 8.0 $28.3