Avon 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

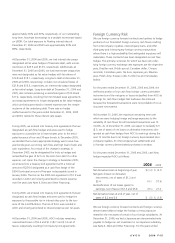

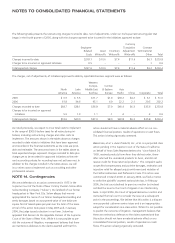

Cash proceeds, tax benefits, and intrinsic value related to total

stock options exercised during 2006, 2005 and 2004, were as

follows:

2006 2005 2004

Cash proceeds from stock options

exercised $32.5 $61.4 $122.3

Tax benefit realized for stock options

exercised 4.1 20.6 36.6

Intrinsic value of stock options

exercised 11.7 57.1 116.1

Restricted Stock and Restricted Stock Units

The fair value of restricted stock and restricted stock units was

determined based on the average of the high and low market

prices of our common stock on the grant date.

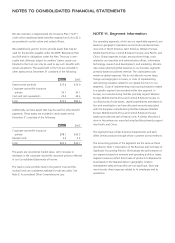

A summary of restricted stock and restricted stock units as of

December 31, 2006, and changes during 2006, is as follows:

Restricted

Stock

And Units

(in 000's)

Weighted-

Average

Grant-Date

Fair Value

Nonvested at January 1, 2006 1,036 $33.53

Granted 1,307 31.04

Vested (280) 29.38

Forfeited (83) 30.02

Nonvested at December 31, 2006 1,980 $32.54

The total fair value of restricted stock and restricted stock units

that vested during 2006 was $8.2, based upon market prices on

the vesting dates. As of December 31, 2006, there was approx-

imately $33.6 of unrecognized compensation cost related to

restricted stock and restricted stock unit compensation arrange-

ments. That cost is expected to be recognized over a weighted-

average period of 2.1 years.

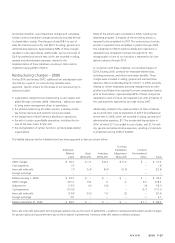

2005-2007 Performance Cash Plan

In 2005, we established a three-year performance cash plan for

the period 2005-2007 (the “Plan”). Awards were set with the

objective of payouts ranging from 30% of target for the

achievement of threshold financial objectives aligned with our

long-term business plan to 200% of target if maximum

performance objectives are achieved. The Compensation Com-

mittee of the Board of Directors has designated total revenues

and operating margin as the key performance measures under

the Plan. If the objectives under the Plan are achieved, total cash

payments in the range of approximately $9.0 to $57.0 would be

made in the first quarter of 2008. Management has determined

that the likelihood of achieving the objectives is remote; there-

fore, no expense has been recognized during 2006 or 2005.

NOTE 9. Shareholders' Equity

Stock Split and Dividends

At the May 6, 2004 Annual Meeting, the shareholders approved

an amendment to our Restated Certificate of Incorporation to

increase the number of shares of authorized common stock from

800 million to 1.5 billion. Conditioned on such approval, the

Board of Directors in February 2004 had declared a two-for-one

stock split in the form of a 100% stock dividend, payable

May 28, 2004, to shareholders of record on May 17, 2004. The

stock split has been recognized by reclassifying the $.25 par

value of the additional shares resulting from the split from

retained earnings to common stock. The effect of this stock split

was not retroactively reflected in the Consolidated Statements of

Changes in Shareholders’ Equity for periods prior to the split;

therefore, in 2004, shares issued for option exercises which

occurred prior to the stock split have not been adjusted for the

stock split. The effect of the stock split on such option exercises

of approximately 1.7 million shares is included in the line

two-for-one stock split effected in the form of a dividend on the

Consolidated Statements of Changes in Shareholders’ Equity. All

references to the number of shares and per share amounts else-

where in the financial statements and related footnotes have

been restated to reflect the effect of the split for all periods

presented.

Share Rights Plan

We have a Share Rights Plan under which one right has been

declared as a dividend for each outstanding share of its common

stock. Each right, which is redeemable at $.005 at any time at

our option, entitles the shareholder, among other things, to

purchase one share of Avon common stock at a price equal to

one-half of the then current market price, if certain events have

occurred. The right is exercisable if, among other events, one

party obtains beneficial ownership of 20% or more of Avon's

voting stock. The description and terms of the rights are set forth

in a Rights Agreement between Avon and Computer Share

Limited.

Stock Repurchase Program

In September 2000, our Board approved a share repurchase

program under which we may buy up to $1,000.0 of our out-

standing stock over the next five years. This $1,000.0 program

was completed during August 2005. In August 2005, we

announced that our Board of Directors authorized us to

repurchase an additional $500.0 of our common stock. The

$500.0 program was completed during December 2005. In

February 2005, we announced that we would begin a new five-

year, $1,000.0 share repurchase program upon completion of

our previous share repurchase program. At December 31, 2006,

there was $647.7 remaining to be repurchased under the

$1,000.0 share repurchase program announced in February