Avon 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension trust assets are invested so as to achieve a return on

investment, based on levels of liquidity and investment risk that

is prudent and reasonable as circumstances change from time to

time. While we recognize the importance of the preservation of

capital, we also adhere to the theory of capital market pricing

which maintains that varying degrees of investment risk should

be rewarded with compensating returns. Consequently, prudent

risk-taking is justifiable.

The asset allocation decision includes consideration of the

non-investment aspects of the Avon Products, Inc. Personal

Retirement Account Plan, including future retirements,

lump-sum elections, growth in the number of participants,

company contributions, and cash flow. These actual character-

istics of the plan place certain demands upon the level, risk, and

required growth of trust assets. We regularly conduct analyses of

the plan’s current and likely future financial status by forecasting

assets, liabilities, benefits and company contributions over time.

In so doing, the impact of alternative investment policies upon

the plan’s financial status is measured and an asset mix which

balances asset returns and risk is selected.

Our decision with regard to asset mix is reviewed periodically.

Asset mix guidelines include target allocations and permissible

ranges for each asset category. Assets are monitored on an

ongoing basis and rebalanced as required to maintain an asset

mix within the permissible ranges. The guidelines will change

from time to time, based on an ongoing evaluation of the plan’s

tolerance of investment risk.

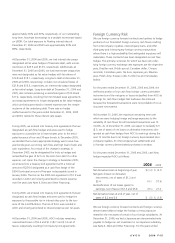

Cash Flows

We expect to contribute up to approximately $23.0 and $70.0 to

our U.S. and non-U.S. pension plans, respectively, in 2007.

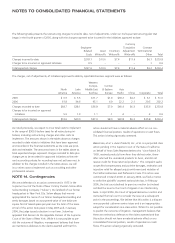

Total benefit payments expected to be paid from the plans are as

follows:

Pension Benefits

Postretirement

Benefits

U.S.

Plans

Non-U.S.

Plans Total

Gross

Payments

Federal

Subsidy

2007 $134.2 $ 37.0 $171.2 $12.5 $ 1.8

2008 96.0 35.0 131.0 12.9 1.9

2009 69.5 35.8 105.3 13.4 2.0

2010 64.2 37.8 102.0 13.8 2.1

2011 63.9 37.7 101.6 14.4 2.4

2012 – 2016 272.2 208.1 480.3 74.1 12.2

Postretirement Benefits

For 2006, the assumed rate of future increases in the per capita

cost of health care benefits (the health care cost trend rate) was

9.0% for all claims and will gradually decrease each year there-

after to 5.0% in 2012 and beyond. A one-percentage point

change in the assumed health care cost trend rates would have

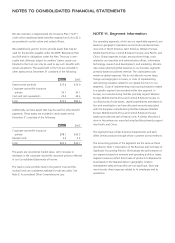

the following effects:

(In millions)

1 Percentage

Point Increase

1 Percentage

Point Decrease

Effect on total of service and

interest cost components 1.7 (1.5)

Effect on postretirement

benefit obligation 16.5 (14.9)

Postemployment Benefits

We provide postemployment benefits, which include salary con-

tinuation, severance benefits, disability benefits, continuation of

health care benefits and life insurance coverage to eligible for-

mer employees after employment but before retirement. At

December 31, 2006 and 2005, the accrued cost for

postemployment benefits was $53.7 and $51.6, respectively,

and was included in employee benefit plans.

Supplemental Retirement Programs

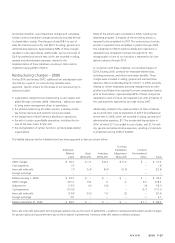

We offer the Avon Products, Inc. Deferred Compensation Plan

(the “Plan”) for certain key employees. The Plan is an unfunded,

unsecured plan for which obligations are paid to participants out

of our general assets, including assets held in a grantor trust,

described below, and corporate-owned life insurance policies.

The Plan allows for the deferral of up to 50% of a participant’s

base salary, the deferral of up to 100% of incentive compensa-

tion bonuses, and the deferral of contributions that would have

been made to the Avon Personal Savings Account Plan (the

“PSA”) but that are in excess of U.S. Internal Revenue Code lim-

its on contributions to the PSA. Participants may elect to have

their deferred compensation invested in one or more of three

investment alternatives. Expense associated with the Plan for the

years ended December 31, 2006, 2005 and 2004, was $6.1,

$5.8 and $4.2, respectively. At December 31, 2006, the accrued

cost for the deferred compensation plan was $101.5 (2005 –

$99.3) and was included in other liabilities.

We maintain supplemental retirement programs consisting of a

Supplemental Executive Retirement and Life Plan (“SERP”) and

the Benefits Restoration Pension Plan of Avon Products, Inc.

(“Restoration Plan”) under which non-qualified supplemental

pension benefits are paid to higher paid employees in addition

to amounts received under our qualified retirement plan, which

is subject to IRS limitations on covered compensation. The

annual cost of this program has been included in the determi-

nation of the net periodic benefit cost shown above and in 2006

amounted to $12.5 (2005 – $12.1; 2004 – $12.2). The benefit

obligation under this program at December 31, 2006, was $54.5

(2005 – $58.8) and was included in employee benefit plans.

A V O N 2006 F-23