Avon 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

3%, reflecting strong Beauty growth driven by successful new

product launches and increased advertising.

Incremental costs, during 2006, associated with implementing

restructuring initiatives, primarily costs related to delayering,

drove the operating margin decline, and negatively impacted

segment operating margin 3.0 points in 2006. Other con-

tributing items include $21.0 of expense associated with the

resolution of a value-added tax dispute in the U.K in the third

quarter of 2006; incremental inventory obsolescence expense

related to our inventory initiatives; unfavorable foreign exchange

on imported inventory in Turkey; spending on advertising; higher

allocation of global expenses; and costs related to the

implementation of an enterprise resource planning system. These

unfavorable year-over-year comparisons were partially offset by

the impact of higher revenue and benefits associated with

restructuring initiatives, primarily compensation-related savings

associated with our delayering initiative.

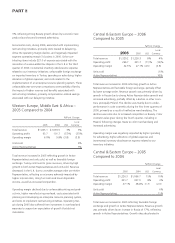

Western Europe, Middle East & Africa –

2005 Compared to 2004

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $1,065.1 $1,035.5 3% 3%

Operating profit 63.7 101.7 (37)% (37)%

Operating margin 6.0% 9.8% (3.8) (3.8)

Units sold 4%

Active Representatives 5%

Total revenue increased in 2005 reflecting growth in Active

Representatives and units sold, as well as favorable foreign

exchange. Turkey continued to grow revenues, driven by high

growth in both Active Representatives and units sold. Revenue

decreased in the U.K. due to a smaller average order per Active

Representative, reflecting an economy adversely impacted by

higher interest rates, rising fuel costs and lower disposable

income, as well as increased competition.

Operating margin declined due to unfavorable pricing and prod-

uct mix, higher manufacturing overhead, costs associated with

planning and developing an enterprise resource planning system,

and costs to implement restructuring initiatives. Operating mar-

gin during 2005 also suffered from investment in overhead and

expenses to support an expectation of growth that did not

materialize.

Central & Eastern Europe – 2006

Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $1,320.2 $1,226.3 8% 4%

Operating profit 296.7 331.7 (11)% (14)%

Operating margin 22.5% 27.1% (4.6) (4.8)

Units sold (1)%

Active Representatives 10%

Total revenue increased in 2006 reflecting growth in Active

Representatives and favorable foreign exchange, partially offset

by lower average order. Revenue growth was primarily driven by

growth in Russia due to strong Active Representative growth and

increased advertising, partially offset by a decline in other coun-

tries, principally Poland. This decline was mainly due to under-

performance in color cosmetics during the first three quarters of

2006, primarily as a result of ineffective merchandising. The

declines were also due to increased competition in Beauty. Color

cosmetics sales grew during the fourth quarter, including in

Poland, following changes made to color merchandising and

increased advertising.

Operating margin was negatively impacted by higher spending

for advertising, higher allocation of global expenses and

incremental inventory obsolescence expense related to our

inventory initiatives.

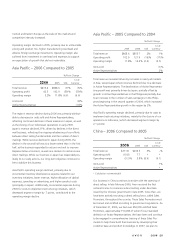

Central & Eastern Europe – 2005

Compared to 2004

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $1,226.3 $1,066.7 15% 10%

Operating profit 331.7 307.0 8% 3%

Operating margin 27.1% 28.8% (1.7) (2.0)

Units sold 6%

Active Representatives 11%

Total revenue increased in 2005 reflecting favorable foreign

exchange and growth in Active Representatives. Revenue growth

was primarily driven by an increase in Russia of 17%, reflecting

growth in Active Representatives. Growth rates decelerated in