Avon 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

approximately 30% and 60%, respectively, of our outstanding

long-term, fixed-rate borrowings to a variable interest rate based

on LIBOR. Our total exposure to floating interest rates at

December 31, 2006 and 2005 was approximately 50% and

80%, respectively.

At December 31, 2006 and 2005, we had interest rate swaps

designated as fair value hedges of fixed-rate debt, with unreal-

ized losses of $23.9 and $14.5, respectively. Additionally, at

December 31, 2006 and 2005, we had interest rate swaps that

were not designated as fair value hedges with fair values of

$13.8 and $18.1, respectively. Long-term debt at December 31,

2006 and 2005, respectively, includes net unrealized losses of

$21.8 and $15.3, respectively, on interest rate swaps designated

as fair value hedges. Long-term debt at December 31, 2006 and

2005, also includes remaining unamortized gains of $12.8 and

$17.2, respectively, resulting from terminated swap agreements

and swap agreements no longer designated as fair value hedges,

which are being amortized to interest expense over the remain-

ing terms of the underlying debt. There was no hedge

ineffectiveness for the years ended December 31, 2006, 2005

and 2004, related to these interest rate swaps.

During 2005, we entered into treasury lock agreements that we

designated as cash flow hedges and were used to hedge

exposure to a possible rise in interest rates prior to the antici-

pated issuance of ten- and 30-year bonds. In December 2005,

we decided that a more appropriate strategy was to issue five-

year bonds given our strong cash flow and high level of cash and

cash equivalents. As a result of the change in strategy, in

December 2005, we de-designated the locks as hedges and

reclassified the gain of $2.5 on the locks from AOCI to other

expense, net. Upon the change in strategy in December 2005,

we entered into a treasury lock agreement with a notional

amount of $250.0 designated as a cash flow hedge of the

$500.0 principal amount of five-year notes payable issued in

January 2006. The loss on the 2005 lock agreement of $1.9 was

recorded in AOCI and is being amortized to interest expense

over five years (see Note 4, Debt and Other Financing).

During 2003, we entered into treasury lock agreements that we

designated as cash flow hedges and were used to hedge the

exposure to the possible rise in interest rates prior to the issu-

ance of the 4.625% Notes. The loss of $2.6 was recoded in

AOCI and is being amortized to interest expense over ten years.

At December 31, 2006 and 2005, AOCI includes remaining

unamortized losses of $3.3 and $1.9 ($2.1 and $1.3 net of

taxes), respectively resulting from treasury lock agreements.

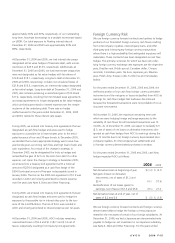

Foreign Currency Risk

We use foreign currency forward contracts and options to hedge

portions of our forecasted foreign currency cash flows resulting

from intercompany royalties, intercompany loans, and other

third-party and intercompany foreign currency transactions

where there is a high probability that anticipated exposures will

materialize. These contracts have been designated as cash flow

hedges. The primary currencies for which we have net under-

lying foreign currency exchange rate exposures are the Argentine

peso, Brazilian real, British pound, Canadian dollar, Chinese

renminbi, Colombian peso, the Euro, Japanese yen, Mexican

peso, Polish zloty, Russian ruble, Turkish lira and Venezuelan

bolivar.

For the years ended December 31, 2006, 2005 and 2004, the

ineffective portion of our cash flow foreign currency derivative

instruments and the net gains or losses reclassified from AOCI to

earnings for cash flow hedges that had been discontinued

because the forecasted transactions were not probable of occur-

ring were not material.

At December 31, 2006, the maximum remaining term over

which we were hedging foreign exchange exposures to the

variability of cash flows for all forecasted transactions was 12

months. As of December 31, 2006, we expect to reclassify $.5

($.3, net of taxes) of net losses on derivative instruments des-

ignated as cash flow hedges from AOCI to earnings during the

next 12 months due to (a) foreign currency denominated inter-

company royalties, (b) intercompany loan settlements and

(c) foreign currency denominated purchases or receipts.

For the years ended December 31, 2006 and 2005, cash flow

hedges impacted AOCI as follows:

2006 2005

Net derivative losses at beginning of year $ (1.3) $ (4.7)

Net gains (losses) on derivative

instruments, net of taxes of $1.2 and

$3.4 10.1 (17.6)

Reclassification of net losses (gains) to

earnings, net of taxes of $1.3 and $5.8 (9.1) 21.0

Net derivative losses at end of year, net of

taxes of $.2 and $.4 $ (.3) $ (1.3)

We use foreign currency forward contracts and foreign currency-

denominated debt to hedge the foreign currency exposure

related to the net assets of certain of our foreign subsidiaries. At

December 31, 2006, we had a Japanese yen-denominated note

payable to hedge our net investment in our Japanese subsidiary

(see Note 4, Debt and Other Financing). For the years ended

A V O N 2006 F-15