Avon 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

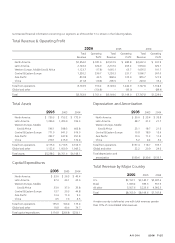

Long-Lived Assets by Major Country

2006 2005 2004

U.S. $ 418.2 $ 431.0 $ 415.3

Colombia 145.1 163.3 –

Poland 123.4 121.1 135.0

All other 792.5 703.6 649.5

Total $1,479.2 $1,419.0 $1,199.8

A major country is defined as one with long-lived assets greater

than 10% of consolidated long-lived assets. Long-lived assets

primarily include property, plant and equipment and intangible

assets. Colombia’s long-lived assets consist primarily of goodwill

and intangible assets associated with the 2005 acquisition of this

business (See Note 16, Goodwill and Intangible Assets). Poland’s

long-lived assets consist primarily of property, plant and equip-

ment related to a European manufacturing facility.

Revenue by Product Category

2006 2005 2004

Beauty (1) $6,028.8 $5,588.7 $5,259.6

Beauty Plus (2) 1,676.6 1,527.0 1,401.9

Beyond Beauty (3) 971.9 949.5 994.7

Net sales 8,677.3 8,065.2 7,656.2

Other revenue (4) 86.6 84.4 91.6

Total revenue $8,763.9 $8,149.6 $7,747.8

(1) Beauty includes cosmetics, fragrances, skin care and toiletries.

(2) Beauty Plus includes fashion jewelry, watches, apparel and accessories.

(3) Beyond Beauty includes home products and gift and decorative

products.

(4) Other primarily includes shipping and handling fees billed to

Representatives.

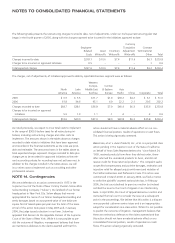

NOTE 12. Leases and Commitments

Minimum rental commitments under noncancellable operating

leases, primarily for equipment and office facilities at

December 31, 2006, are included in the following table under

leases. Purchase obligations include commitments to purchase

paper, inventory and other services.

Year Leases

Purchase

Obligations

2007 $ 88.0 $222.9

2008 70.6 87.5

2009 54.3 62.0

2010 36.8 47.9

2011 32.6 16.3

Later years 69.9 79.4

Sublease rental income (11.3) –

Total $340.9 $516.0

Rent expense in 2006 was $114.7 (2005 – $109.2; 2004 –

$109.9). Plant construction, expansion and modernization proj-

ects with an estimated cost to complete of approximately $76.4

were in progress at December 31, 2006.

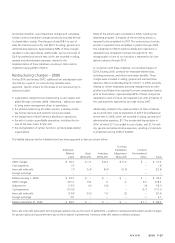

NOTE 13. Restructuring Initiatives

In November 2005, we announced a multi-year turnaround plan

as part of a major drive to fuel revenue growth and expand

profit margins, while increasing consumer investments. As part

of our turnaround plan, restructuring initiatives include:

• enhancement of organizational effectiveness, including efforts

to flatten the organization and bring senior management

closer to consumers through a substantial organization

downsizing;

• implementation of a global manufacturing strategy through

facilities realignment;

• additional supply chain efficiencies in distribution; and

• streamlining of transactional and other services through out-

sourcing and moves to low-cost countries.

We expect to incur restructuring charges and other costs to

implement these initiatives in the range of $500.0 before taxes.

We incurred a significant portion of the total costs to implement

these initiatives during 2006, but we expect to incur additional

significant charges over the next few years.

Restructuring Charges – 2005

In December 2005 and January 2006, exit and disposal activities

that are a part of this multi-year restructuring plan were

approved. Specific actions for this initial phase of our multi-year

restructuring plan included:

• organization realignment and downsizing in each region and

global through a process called “delayering,” taking out layers

to bring senior management closer to operations;

• the exit of unprofitable lines of business or markets, including

the closure of unprofitable operations in Asia, primarily

Indonesia and the exit of a product line in China, and the exit

of the beComing product line in the U.S.; and

• the move of certain services from markets within Europe to

lower cost shared service centers.

The actions described above were completed during 2006,

except for the move of certain services from markets within

Europe to lower cost shared service centers, which is expected to

be completed in phases through 2008.

In connection with these initiatives, we recorded charges of

$51.6 pretax in the fourth quarter of 2005, primarily for

employee related costs, including severance, pension and other