Avon 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

diluted EPS because the exercise prices of those options were

greater than the average market price and their inclusion would

be anti-dilutive.

NOTE 2. New Accounting Standards

Standards Implemented

Effective January 1, 2006, we adopted SFAS No. 123 (revised

2004), Share-Based Payment (“SFAS 123R”). See Note 1,

Description of Business and Summary of Significant Accounting

Policies, and Note 8, Share-Based Compensation Plans and Other

Long-Term Incentive Plan, for additional information.

Effective December 31, 2006, we adopted SFAS No. 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements

No. 87, 88, 106 and 132R (“SFAS 158”).See Note 10, Employee

Benefit Plans, for additional information.

Effective December 31, 2006, we adopted Staff Accounting

Bulletin No. 108, Considering the Effects of Prior Year Misstate-

ments when Quantifying Misstatements in Current Year Financial

Statements (“SAB 108”), which provides interpretive guidance

on the consideration of the effects of prior year misstatements in

quantifying current year misstatements for the purpose of a

materiality assessment. SAB 108 allows for a one-time transi-

tional cumulative effect adjustment to beginning retained earn-

ings as of January 1, 2006, for errors that were not previously

deemed material, but are material under the guidance in SAB

108. The adoption of SAB 108 had no impact on our Con-

solidated Financial Statements.

Effective January 1, 2006, we adopted SFAS No. 151, Inventory

Costs (“SFAS 151”), which requires certain inventory-related

costs to be expensed as incurred. The adoption of SFAS 151 had

no impact on our Consolidated Financial Statements.

Standards to be Implemented

In June 2006, the FASB issued FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes – an interpretation

of FASB Statement No. 109, (“FIN 48”). FIN 48 prescribes a con-

sistent recognition threshold and measurement attribute, as well

as criteria for subsequently recognizing, derecognizing and

measuring uncertain tax positions for financial statement pur-

poses. FIN 48 also requires expanded disclosure with respect to

the uncertainty in income taxes. FIN 48 is effective January 1,

2007, for Avon. The impact of adopting FIN48 is not expected to

be material based on work performed to date, but we continue

to assess the impact of FIN48 along with implementation guid-

ance as it is issued.

In September 2006, the FASB issued SFAS No. 157, Fair Value

Measurements (“SFAS 157”), which defines fair value, estab-

lishes a framework for measuring fair value in accordance with

generally accepted accounting principles, and expands dis-

closures about fair value measurements. SFAS 157 is effective

January 1, 2008, for Avon. We are currently evaluating the

impact of SFAS 157 on our Consolidated Financial Statements.

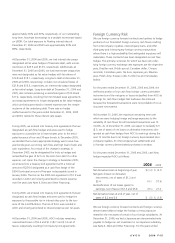

NOTE 3. Inventories

Inventories at December 31 consisted of the following:

2006 2005

Raw materials $260.6 $208.3

Finished goods 639.7 593.4

Total $900.3 $801.7

NOTE 4. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2006 2005

Debt maturing within one year:

Notes payable $ 81.9 $ 44.0

Commercial paper 335.9 756.9

6.55% Notes, due August 2007 100.0 –

1.06% Yen Notes, due September 2006 – 76.7

Yen credit facility 92.9 –

Current portion of long-term debt 4.9 4.9

Total $ 615.6 $882.5

Long-term debt:

5.125% Notes, due January 2011 $ 499.5 $ –

6.55% Notes, due August 2007 – 100.0

7.15% Notes, due November 2009 300.0 300.0

4.625% Notes, due May 2013 110.1 108.3

4.20% Notes, due July 2018 249.0 248.9

Other, payable through 2010 with

interest from 1% to 15% 26.0 12.3

Total long-term debt 1,184.6 769.5

Adjustments for debt with fair value

hedges (9.0) 1.9

Less current portion (4.9) (4.9)

Total $1,170.7 $766.5

At December 31, 2006 and 2005, notes payable included short-

term borrowings of international subsidiaries at average annual

interest rates of approximately 6.3% and 5.1%, respectively.

Other long-term debt, payable through 2010, includes obliga-

tions under capital leases of $11.8, which primarily relate to

leases of automobiles.