Avon 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

initiate a removal program, consistent with removal programs in

our other markets, to eliminate inactive certified Sales Promoters

after a period of time. Since we received our license, other

companies have received direct selling licenses, with two large

multi-national competitors receiving regional licenses in late

2006.

Prior to the reopening of direct selling we had sold our products

in China through a network of licensed beauty boutiques, as

well as dealer-owned and company-owned store counters. The

company-owned store counters were exited as part of our

restructuring initiatives. In addition to being a retail boutique, a

beauty boutique can now participate in direct selling by operat-

ing as a service center to the Sales Promoters, an essential ele-

ment of the direct selling model stipulated in the Direct Selling

regulations, for which they can earn service fees from Avon.

China’s revenue is now generated through Sales Promoters,

beauty boutiques and dealer-owned counters.

Total revenue increased in 2006, as significant growth in direct

selling more than offset the lower revenue from beauty bou-

tiques, as they reduced their order sizes in connection with the

resumption of direct selling, as well as the unfavorable impact of

the exit of company-owned counters, which had a negative

nine-point impact on 2006 revenue growth. Total revenue in

2006 also benefited from the favorable effects of foreign

exchange. Due to the significant growth of direct selling since

our March 2006 launch, direct selling is becoming a greater por-

tion of our business and is expected to continue as it is built up.

At the same time that we have been building on direct selling,

we have stabilized our beauty boutiques. During 2006, we have

not experienced a significant decline in the number of beauty

boutiques, and we ended 2006 with a similar number of active

beauty boutiques as compared to the beginning of 2006.

The operating margin decrease was primarily driven by sig-

nificantly higher spending on advertising, fees paid to registered

service centers for providing services to our Active Representa-

tives, and other costs associated with the launch of direct selling.

China – 2005 Compared to 2004

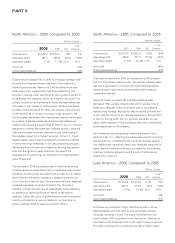

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $206.5 $223.0 (7)% (8)%

Operating profit 7.7 35.2 (78)% (78)%

Operating margin 3.8% 15.8% (12.0) (12.0)

Units sold (3)%

Active Representatives *

* Calculation not meaningful

Revenue in China declined 7% as the beauty boutique owners

reduced the size of their orders as compared to the prior year in

connection with the anticipated resumption of direct selling

discussed above.

Operating margin decreased driven by incremental costs to

prepare for direct selling and the cost of maintaining our

consumer investment, primarily through advertising, against a

significantly lower revenue base.

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of funds historically have been cash flows

from operations, commercial paper and borrowings under lines

of credit. We currently believe that existing cash, cash from

operations (including the impacts of cash required for restructur-

ing initiatives) and available sources of public and private financ-

ing are adequate to meet anticipated requirements for working

capital, dividends, capital expenditures, the stock repurchase

program, possible acquisitions and other cash needs.

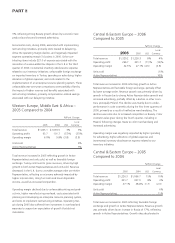

Balance Sheet Data

2006 2005

Cash and cash equivalents $1,198.9 $1,058.7

Total debt 1,786.3 1,649.0

Working capital 784.2 419.3

Cash Flows

2006 2005 2004

Net cash provided by

operating activities $ 796.1 $ 895.5 $ 882.6

Net cash used by investing

activities (207.9) (343.1) (279.4)

Net cash used by financing

activities (490.4) (226.7) (567.0)

Effect of exchange rate

changes on cash and

equivalents 42.4 (36.6) 39.4

Net Cash Provided by Operating Activities

Net cash provided by operating activities decreased by $99.4

during 2006, primarily due to cash payments of approximately

$117.0 associated with restructuring charges, and additional

cash payments associated with other costs to implement

restructuring initiatives. To a lesser extent, unfavorable working

capital levels in inventory and accounts receivable contributed to

the decrease in net cash provided by operating activities. These

decreases in operating cash flow were partially offset by