Avon 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

revenues increased 32% due to larger average order and

increased Active Representatives, reflecting new product

launches supported by significant advertising and promotional

activities. The increase in revenue in Brazil and the acquisition

and growth of Colombia more than compensated for continued

declines in Mexico, where revenues decreased 6%, mainly due

to a decline in Active Representatives. The decline in Active

Representatives reflected, in part, challenges related to field

execution caused by a change in the attractiveness of incentives,

including ineffective performance management for our zone

managers. In 2006, we have commenced a number of initiatives

to improve performance in Mexico, including an upgrade of field

talent and investments in incentives and motivation programs,

and we may see improvement by the end of 2007, as we con-

tinue to increase advertising and focus on field execution

through the Representative Value Proposition. We also plan to

continue to focus on our supply chain transition in Mexico.

The decrease in operating margin in Latin America during 2006

was most significantly impacted by increased spending on adver-

tising, incremental inventory obsolescence expense related to our

inventory initiatives, higher allocation of global expenses, and a

2005 gain on the sale of property in Mexico, partially offset by

operating efficiencies due to the revenue increase. Additionally,

incremental costs to implement our restructuring initiatives neg-

atively impacted operating margin by 1.1 points.

Currency restrictions enacted by the Venezuelan government in

2003 have become more restrictive and have further impacted

the ability of our subsidiary in Venezuela (“Avon Venezuela”) to

obtain foreign currency at the official rate to pay for imported

products. As a result of this increased difficulty, during 2006,

Avon Venezuela purchased approximately $17.6 in the parallel

market that resulted in a foreign exchange loss of $4.5. Unless

official foreign exchange is made more readily available, Avon

Venezuela’s operations will continue to be negatively impacted

as it will need to obtain more of its foreign currency needs from

the parallel market.

At December 31, 2006, Avon Venezuela had cash balances of

approximately $76.0, primarily denominated in bolivars. During

the year, Avon Venezuela remitted dividends of $26.2 at the

official exchange rate. As a result, we continue to use the official

rate to translate the financial statements of Avon Venezuela into

U.S. dollars. In 2006, Avon Venezuela’s revenue and operating

profit represented approximately 3% and 7% of consolidated

revenue and consolidated operating profit, respectively.

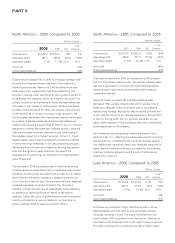

Latin America – 2005 Compared to 2004

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $2,272.6 $1,934.6 17% 10%

Operating profit 453.2 420.7 8% –%

Operating margin 19.9% 21.7% (1.8) (1.9)

Units sold 8%

Active Representatives 11%

Total revenue increased in 2005 with increases in all markets in

the region, except Mexico, reflecting growth in Active Repre-

sentatives, as well as favorable foreign exchange. The purchase

of our licensee in Colombia favorably impacted Latin America’s

revenue and Active Representative growth by 2%. Revenue grew

significantly in Brazil, primarily due to growth in units sold and

Active Representatives, incremental consumer and field incentive

programs, as well as favorable foreign exchange. The revenue

decline in Mexico reflected increased competitive intensity and a

significant decline in non-Beauty product offerings, partially

offset by favorable foreign exchange.

Operating margin declined in Latin America during 2005, mainly

affected by increased fixed expenses, primarily salaries, costs to

implement restructuring initiatives, unfavorable product mix,

pricing investments and incremental inventory obsolescence

expense related to our inventory initiatives, partially offset by

benefits from supply chain efficiencies and a gain on the sale of

property in Mexico.

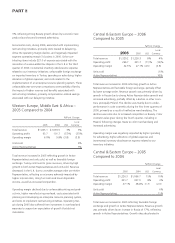

Western Europe, Middle East & Africa –

2006 Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $1,123.7 $1,065.1 6% 6%

Operating profit (17.8) 63.7 * *

Operating margin (1.6)% 6.0% (7.6) (7.5)

Units sold 3%

Active Representatives 2%

* Calculation not meaningful

Total revenue increased reflecting growth in Active Representa-

tives and units, with increases in revenues in most markets in the

region, most significantly in Turkey and the U.K. Revenue growth

of 23% in Turkey benefited from the continued strength of

recruiting and field programs, as well as investments in advertis-

ing driving increased order size. Revenue in the U.K increased

A V O N 2006 27