Avon 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

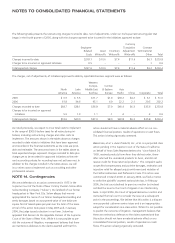

The following table presents the restructuring charges incurred to date, net of adjustments, under our multi-year restructuring plan that

began in the fourth quarter of 2005, along with the charges expected to be incurred for the initiatives approved to date:

Employee-

Related

Costs

Asset

Write-offs

Inventory

Write-offs

Currency

Translation

Adjustment

Write-offs

Contract

Terminations/

Other Total

Charges incurred to date $218.1 $10.6 $7.4 $11.6 $6.1 $253.8

Charges to be incurred on approved initiatives 9.5 – – – .1 9.6

Total expected charges $227.6 $10.6 $7.4 $11.6 $6.2 $263.4

The charges, net of adjustments, of initiatives approved to date by reportable business segment were as follows:

North

America

Latin

America

Western

Europe,

Middle East

& Africa

Central

& Eastern

Europe

Asia

Pacific China Corporate Total

2005 $ 6.9 $ 3.5 $11.7 $1.0 $18.2 $4.2 $ 6.1 $ 51.6

2006 61.8 34.6 45.1 6.9 22.2 2.1 29.5 202.2

Charges recorded to date $68.7 $38.1 $56.8 $7.9 $40.4 $6.3 $35.6 $253.8

Charges to be incurred on approved

initiatives 5.9 1.9 1.1 .1 .4 – .2 9.6

Total expected charges $74.6 $40.0 $57.9 $8.0 $40.8 $6.3 $35.8 $263.4

As noted previously, we expect to incur total costs to implement

in the range of $500.0 before taxes for all restructuring ini-

tiatives, including restructuring charges and other costs to

implement. The amounts shown in the tables above as charges

recorded to date relate to initiatives that have been approved

and recorded in the financial statements as the costs are prob-

able and estimable. The amounts shown in the tables above as

total expected charges represent charges recorded to date plus

charges yet to be recorded for approved initiatives as the rele-

vant accounting criteria for recording have not yet been met. In

addition to the charges included in the tables above, we will

incur other costs to implement such as consulting and other

professional services.

NOTE 14. Contingencies

We are a defendant in an action commenced in 1975 in the

Supreme Court of the State of New York by Sheldon Solow d/b/a

Solow Building Company (“Solow”), the landlord of our former

headquarters in New York City. Solow alleges that we mis-

appropriated the name of our former headquarters building and

seeks damages based on a purported value of one dollar per

square foot of leased space per year over the term of the lease.

A trial of this action took place in May 2005 and, in January

2006, the judge issued a decision in our favor. Solow has

appealed that decision to the Appellate Division of the Supreme

Court of the State of New York. While it is not possible to pre-

dict the outcome of litigation, management believes that there

are meritorious defenses to the claims asserted and that this

action should not have a material adverse effect on our con-

solidated financial position, results of operations or cash flows.

This action is being vigorously contested.

Blakemore, et al. v. Avon Products, Inc., et al. is a purported class

action pending in the Superior Court of the State of California

on behalf of Avon Sales Representatives who “since March 24,

1999, received products from Avon they did not order, there-

after returned the unordered products to Avon, and did not

receive credit for those returned products.” The complaint seeks

unspecified compensatory and punitive damages, restitution and

injunctive relief for alleged unjust enrichment and violation of

the California Business and Professions Code. This action was

commenced in March 2003. In January 2006, we filed a motion

to strike the plaintiffs’ asserted nationwide class. In February

2006, the trial court declined to grant our motion but instead

certified the issue to the Court of Appeal on an interlocutory

basis. In April 2006, the Court of Appeal denied our motion and

instructed the trial court to consider the issue at a subsequent

point in the proceedings. We believe that this action is a dispute

over purported customer service issues and is an inappropriate

subject for consideration as a class action. While it is not possible

to predict the outcome of litigation, management believes that

there are meritorious defenses to the claims asserted and that

this action should not have a material adverse effect on our

consolidated financial position, results of operations or cash

flows. This action is being vigorously contested.