Avon 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Instruments

We use derivative financial instruments, including interest rate

swaps, forward foreign currency contracts and options, to

manage interest rate and foreign currency exposures. We record

all derivative instruments at their fair values on the Consolidated

Balance Sheets as either assets or liabilities. See Note 7, Financial

Instruments and Risk Management.

Deferred Income Taxes

Deferred income taxes have been provided on items recognized

for financial reporting purposes in different periods than for

income tax purposes using tax rates in effect for the year in

which the differences are expected to reverse. A valuation

allowance is provided for deferred tax assets if it is more likely

than not these items will not be realized. The ultimate realization

of our deferred tax assets depends upon generating sufficient

future taxable income during the periods in which our temporary

differences become deductible or before our net operating loss

carryforwards expire. U.S. income taxes have not been provided

on approximately $2,158.7 of undistributed income of sub-

sidiaries that has been or is intended to be permanently

reinvested outside the United States.

Selling, General and Administrative

Expenses

Selling, general and administrative expenses include costs asso-

ciated with selling; marketing; and distribution activities, includ-

ing shipping and handling costs; research and development;

information technology; and other administrative costs, includ-

ing finance, legal, and human resource functions.

Shipping and Handling

Shipping and handling costs are expensed as incurred and

amounted to $787.0 in 2006 (2005 – $706.0; 2004 – $680.0).

Shipping and handling costs are included in selling, general and

administrative expenses on the Consolidated Statements of

Income.

Advertising

Advertising costs, excluding brochure preparation costs, are

expensed as incurred and amounted to $248.9 in 2006 (2005 –

$135.9; 2004 – $127.6).

Research and Development

Research and development costs are expensed as incurred and

amounted to $65.8 in 2006 (2005 – $64.2; 2004 – $63.1).

Research and development costs include all costs related to the

design and development of new products such as salaries and

benefits, supplies and materials and facilities costs.

Restructuring Reserves

We record severance-related expenses once they are both prob-

able and estimable in accordance with the provisions of SFAS

No. 112, Employer’s Accounting for Post-Employment Benefits,

for severance provided under an ongoing benefit arrangement.

One-time benefit arrangements and disposal costs, primarily

contract termination costs, are accounted for under the provi-

sions of SFAS No. 146, Accounting for Costs Associated with Exit

or Disposal Activities. We evaluate impairment issues under the

provisions of SFAS No. 144, Accounting for the Impairment or

Disposal of Long-Lived Assets.

Contingencies

In accordance with SFAS No. 5, Accounting for Contingencies,

we determine whether to disclose and accrue for loss con-

tingencies based on an assessment of whether the risk of loss is

remote, reasonably possible or probable. We record loss con-

tingencies when it is probable that a liability has been incurred

and the amount of loss is reasonably estimable.

Reclassifications

We have reclassified some prior year amounts in the Con-

solidated Financial Statements and accompanying notes for

comparative purposes.

Earnings per Share

We compute basic earnings per share (“EPS”) by dividing net

income by the weighted-average number of shares outstanding

during the year. Diluted EPS is calculated to give effect to all

potentially dilutive common shares that were outstanding during

the year.

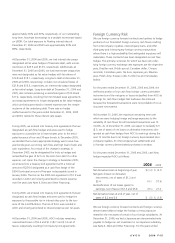

For each of the three years ended December 31, the compo-

nents of basic and diluted EPS were as follows:

(Shares in millions) 2006 2005 2004

Numerator:

Net income $ 477.6 $ 847.6 $ 846.1

Denominator:

Basic EPS weighted-average

shares outstanding 447.40 466.28 472.35

Diluted effect of assumed

conversion of share-based

awards 1.76 3.19 5.61

Diluted EPS adjusted weighted-

average shares outstanding 449.16 469.47 477.96

Earnings Per Share:

Basic $ 1.07 $ 1.82 $ 1.79

Diluted $ 1.06 $ 1.81 $ 1.77

At December 31, 2006 and 2005, we did not include stock

options to purchase 12.9 million shares and 12.1 million shares

of Avon common stock, respectively, in the calculations of

A V O N 2006 F-9