Avon 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

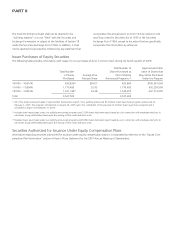

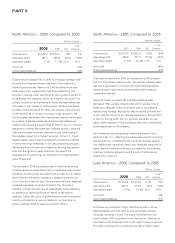

North America – 2006 Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $2,554.0 $2,510.5 2% 1%

Operating profit 181.6 282.8 (36)% (36)%

Operating margin 7.1% 11.3% (4.2) (4.2)

Units sold (4)%

Active Representatives (3)%

Total revenue increased 2% in 2006, as the larger average order

received from Representatives more than offset a decline in

Active Representatives. Revenue in 2006 benefited from new

product launches, supported by significant advertising. The

increase in average order was driven by strong sales of products

in the Beauty Plus category, which has a higher price point. The

primary contributor to the decline in Active Representatives was

a decrease in the number of orders placed. While Active Repre-

sentatives declined overall for 2006, we noted an improvement

in the second half of the year, turning to slight growth in the

fourth quarter. We believe this improvement was primarily driven

by a variety of Representative value-enhancing initiatives we

implemented during the second half of 2006 in our U.S. business

designed to increase Representative ordering activity, combined

with our increased consumer investments and some easing in

the negative impact from higher fuel prices. In the U.S., these

Representative value enhancing initiatives included re-indexing

of certain earnings thresholds in our Sales Leadership program,

distributing bonus brochures to higher-performing Representa-

tives and strengthening sales incentives. We expect this

improvement to continue as we implement our Representative

Value Proposition.

The decrease in 2006 operating margin in North America was

primarily driven by incremental costs to implement restructuring

initiatives, including costs associated with our decision to realign

North America distribution operations, delayering and the clo-

sure of the Avon Salon & Spa. These incremental costs negatively

impacted operating margin by 2.2 points. The decrease in

operating margin was also due to substantially higher spending

on advertising, higher performance-based compensation

expenses, higher allocation of global expenses, and incremental

inventory obsolescence expense related to our inventory ini-

tiatives, partially offset by expense reduction efforts.

North America – 2005 Compared to 2004

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $2,510.5 $2,632.3 (5)% (5)%

Operating profit 282.8 331.9 (15)% (16)%

Operating margin 11.3% 12.6% (1.3) (1.4)

Units sold (6)%

Active Representatives (3)%

Total revenue declined in 2005 as compared to 2004 primarily

due to a 7% decline in Beauty sales. The decline in Beauty sales

was due to decreases in units sold and Active Representatives,

reflecting lower customer purchase frequency and ongoing

competitive intensity.

Beauty Plus sales increased 9% and Beyond Beauty sales

decreased 14%, partially reflecting the shift in product mix in

these two categories which occurred as part of our planned

repositioning strategy. Beauty Plus sales increased primarily due

to the national roll-out of an intimate apparel line, during 2005,

in the U.S. During 2005, the U.S. business exited the toy cat-

egory, which was part of Beyond Beauty and which contributed

to decreased sales in this category.

North American operating margin declined primarily due to

declines in the U.S., reflecting the unfavorable impacts of pricing

and product mix, including the roll-out of the intimate apparel

line. Additionally, operating margin was negatively impacted by

lower revenue combined with costs to implement restructuring

initiatives, primarily delayering and the exit of the beComing

product line in the U.S.

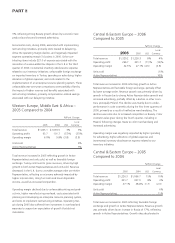

Latin America – 2006 Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $2,743.4 $2,272.6 21% 17%

Operating profit 424.0 453.2 (6)% (10)%

Operating margin 15.5% 19.9% (4.4) (4.5)

Units sold 8%

Active Representatives 11%

Total revenue increased in 2006, reflecting growth in Active

Representatives and units sold, as well as favorable foreign

exchange, primarily in Brazil. The region benefited from the

fourth quarter 2005 acquisition of our licensee in Colombia, as

that market contributed 8 points to the region’s revenue growth.

The region benefited from continued strength in Brazil, where