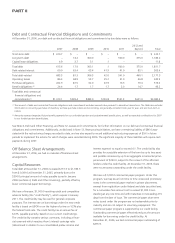

Avon 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

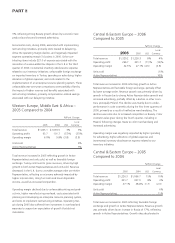

Central and Eastern Europe as the scale of the markets and

competitive intensity increased.

Operating margin declined in 2005, primarily due to unfavorable

pricing and product mix, higher manufacturing overhead and

adverse foreign exchange movements. Operating margin also

suffered from investment in overhead and expenses to support

an expectation of growth that did not materialize.

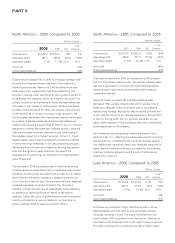

Asia Pacific – 2006 Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $810.8 $868.6 (7)% (6)%

Operating profit 42.5 102.9 (59)% (59)%

Operating margin 5.2% 11.8% (6.6) (6.6)

Units sold (9)%

Active Representatives (10)%

The region’s revenue decline during 2006 was primarily attribut-

able to decreases in units sold and Active Representatives,

reflecting continued declines in these measures in Japan, as well

as the closing of our Indonesian operations in early 2006.

Japan’s revenue declined 21%, driven by declines in the direct

mail business, reflecting the ongoing rebalancing of our efforts

between direct selling fundamentals and the number of direct

mailings. While revenue declined in Japan during 2006, the

decline in the second half was to a lesser extent than in the first

half, as the business responded to actions we took to improve

Representative economics, as well as a decision to restore some

direct mailings. While our business in Japan has responded pos-

itively to our early actions, our long-term objective continues to

be to stabilize this business.

Asia Pacific operating margin declined, primarily due to

incremental inventory obsolescence expense related to our

inventory initiatives, lower revenue, higher allocation of global

expenses, spending on advertising, and higher product costs

(principally in Japan). Additionally, incremental expenses during

2006 for costs to implement restructuring initiatives, which

decreased segment margin by .7 points, contributed to the

operating margin decline.

Asia Pacific – 2005 Compared to 2004

%/Point Change

2005 2004 US$

Local

Currency

Total revenue $868.6 $855.7 2% 1%

Operating profit 102.9 121.9 (16)% (17)%

Operating margin 11.8% 14.2% (2.4) (2.5)

Units sold (1)%

Active Representatives 2%

Total revenue increased driven by increases in nearly all markets

in Asia, except Japan where revenue declined due to a decrease

in Active Representatives. The deceleration of Active Representa-

tive growth was primarily driven by Japan, partially offset by

growth in Active Representatives in the Philippines partially due

to an increase in the number of sales campaigns in the Philip-

pines beginning in the second quarter of 2004, which increased

the Active Representative growth in the region by 2%.

Asia Pacific operating margin declined, primarily due to costs to

implement restructuring initiatives, mainly for the closure of our

operations in Indonesia, (which decreased segment margin by

2.1 points).

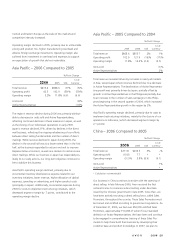

China – 2006 Compared to 2005

%/Point Change

2006 2005 US$

Local

Currency

Total revenue $211.8 $206.5 3% –%

Operating profit (10.8) 7.7 * *

Operating margin (5.1)% 3.8% (8.9) (9.1)

Units sold 1%

Active Representatives *

* Calculation not meaningful

Our business in China continues to evolve with the opening of

direct selling. In late February 2006, Avon received the first

national license to commence direct selling under directives

issued by the Chinese government in late 2005. Since then, we

have been actively recruiting a direct selling force, called Sales

Promoters, throughout the country. These Sales Promoters must

be trained and certified according to government regulations. As

of December 31, 2006, we had over 350,000 certified Sales

Promoters, approximately 150,000 of whom fit our standard

definition of Active Representatives. We have been and continue

to be engaged in comprehensive training of these Sales Pro-

moters to help them build their business by developing their

customer base and product knowledge. In 2007, we plan to

A V O N 2006 29