Avon 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Adjustments for debt with fair value hedges includes adjust-

ments to reflect net unrealized losses of $21.8 and $15.3 on

debt with fair value hedges at December 31, 2006 and 2005,

respectively, and unamortized gains on terminated swap agree-

ments and swap agreements no longer designated as fair value

hedges of $12.8 and $17.2 at December 31, 2006 and 2005,

respectively (see Note 7, Financial Instruments and Risk

Management).

At December 31, 2006, we held interest rate swap contracts that

swap approximately 30% of our long-term debt to variable rates

(see Note 7, Financial Instruments and Risk Management).

In January 2006, we issued in a public offering $500.0 principal

amount of notes payable (“5.125% Notes”) that mature on

January 15, 2011, and bear interest, payable semi-annually, at a

per annum rate equal to 5.125%. The net proceeds from the

offering were used for general corporate purposes, including the

repayment of short-term domestic debt. The carrying value of

the 5.125% Notes represents the $500.0 principal amount, net

of the unamortized discount to face value of $.5 at

December 31, 2006.

In June 2003, we issued to the public $250.0 principal amount

of registered senior notes (the “4.20% Notes”) under our

$1,000.0 debt shelf registration statement. The 4.20% Notes

mature on July 15, 2018, and bear interest at a per annum rate

of 4.20%, payable semi-annually. The net proceeds were used to

repay a portion of convertible notes, which matured in July

2003. The carrying value of the 4.20% Notes represents the

$250.0 principal amount, net of the unamortized discount to

face value of $1.0 and $1.1 at December 31, 2006 and 2005,

respectively.

In April 2003, the call holder of $100.0, 6.25% Notes due May

2018 (the “Notes”), embedded with put and call option fea-

tures, exercised the call option associated with these Notes, and

thus became the sole note holder of the Notes. Pursuant to an

agreement with the sole note holder, we modified these Notes

into $125.0 aggregate principal amount of 4.625% notes due

May 15, 2013. The modified principal amount represented the

original value of the putable/callable notes, plus the market

value of the related call option and approximately $4.0 principal

amount of additional notes issued for cash. In May 2003, $125.0

principal amount of registered senior notes were issued in

exchange for the modified notes held by the sole note holder.

No cash proceeds were received by us. The registered senior

notes mature on May 15, 2013, and bear interest at a per

annum rate of 4.625%, payable semi-annually (the “4.625%

Notes”). The 4.625% Notes were issued under our $1,000.0

debt shelf registration statement. The transaction was accounted

for as an exchange of debt instruments and, accordingly, the

premium related to the original notes is being amortized over

the life of the new 4.625% Notes. At December 31, 2006 and

2005, the carrying value of the 4.625% Notes represents the

$125.0 principal amount, net of the unamortized discount to

face value and the premium related to the call option associated

with the original notes totaling $14.9 and $16.7, respectively.

The indentures under which the above notes were issued contain

certain covenants, including limits on the incurrence of liens and

restrictions on the incurrence of sale/leaseback transactions and

transactions involving a merger, consolidation or sale of sub-

stantially all of our assets. At December 31, 2006, we were in

compliance with all covenants in our indentures.

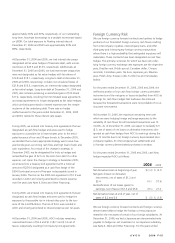

Annual maturities of long-term debt (including unamortized

discounts and premiums and excluding the adjustments for debt

with fair value hedges) outstanding at December 31, 2006, are

as follows:

2007 2008 2009 2010 2011

After

2011 Total

Maturities $4.9 $17.9 $303.1 $.1 $500.0 $375.0 $1,201.0

Other Financing

In August 2006, we entered into a one-year Japanese yen 11.0

billion ($92.9 at the exchange rate on December 31, 2006)

uncommitted credit facility (“yen credit facility”) with the Bank

of Tokyo-Mitsubishi UFJ, Ltd. Borrowings under the yen credit

facility bear interest at the yen LIBOR rate plus an applicable

margin. The yen credit facility is available for general corporate

purposes, including working capital and the repayment of out-

standing indebtedness. The yen credit facility was used to repay

the Japanese yen 9.0 billion note that came due in September

2006, as well as for other general corporate purposes. The yen

credit facility is designated as a hedge of our net investment in

our Japanese subsidiary. At December 31, 2006, $92.9 (Japanese

yen 11.0 billion) was outstanding under the yen credit facility.

We have a five-year, $1,000.0 revolving credit and competitive

advance facility (the “credit facility”), which expires in January

2011. The credit facility may be used for general corporate

purposes. The interest rate on borrowings under the new credit

facility is based on LIBOR or on the higher of prime or 1/2% plus

the federal funds rate. The credit facility has an annual fee of

$.675, payable quarterly, based on our current credit ratings.

A V O N 2006 F-11