Audi 2006 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 9 7

Other particulars

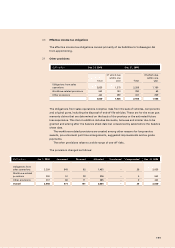

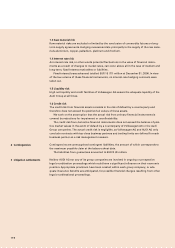

1.1 Price and foreign exchange exposure

The Audi Group is exposed to price and exchange rate fluctuations in view of its interna-

tional business activities. These risks are limited by concluding appropriate hedging trans-

actions for matching amounts and maturities. The measures to hedge against foreign ex-

change exposure are coordinated regularly between AUDI AG and the group treasury of

Volkswagen AG in accordance with the Volkswagen organisational guideline.

Marketable derivative financial instruments (foreign exchange contracts, currency option

transactions and commodity futures) are used for this purpose. The hedging transactions

are performed centrally on behalf of Audi by Volkswagen AG on the basis of an agency

agreement. Contracts are concluded exclusively with top-grade national and international

banks whose creditworthiness is regularly examined by leading rating agencies. The results

from hedging contracts are credited or charged to the Audi Group each month on the basis

of the proportion of the Volkswagen Group’s overall hedging volume.

In accordance with the Volkswagen organisational guideline, AUDI AG moreover con-

cludes hedging transactions of its own to a limited extent, where this helps to simplify cur-

rent operations.

Currency hedging in 2006 related principally to the US dollar, the pound sterling and the

Japanese yen.

Nominal volume of derivative financial instruments

The nominal volumes of the hedging transactions shown represent the total of all buying

and selling prices on which the transactions are based:

EUR million Nominal volumes Market values

Dec. 31, 2006

Time to matu-

rity up to 1 year Dec. 31, 2005

Time to matu-

rity up to 1 year Dec. 31, 2006 Dec. 31, 2005

Foreign exchange contracts 6,667 4,569 5,493 3,448 205 – 128

Currency option transactions 3,186 3,158 2,902 2,836 235 34

Commodity futures 635 191 – – 14 –

Currency swaps 1 1 – – – –

Total portfolio 10,489 7,919 8,395 6,284 454 – 94

1.2 Market risk

A market risk exists if price changes on financial markets have a negative influence on the

value of financial instruments. The market values shown in the table have been calculated

on the basis of the market information available at the balance sheet date and represent the

redemption (cash-in) values of the derivative financial instruments. The redemption values

are calculated on the basis of quoted prices or standardised methods.

1 Hedging policy and risk

management