Audi 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 7 3

The currency of the Audi Group is the euro (EUR).

Foreign currency transactions in the separate financial statements of AUDI AG and the

subsidiaries are translated at the prevailing exchange rate on the date of the transaction.

Monetary items in foreign currency are reported at the balance sheet date on the basis of

the exchange rate on that date. Exchange differences are recognised in the current-period

income statements of the respective group companies.

The foreign companies belonging to the Audi Group are foreign entities which prepare

their financial statements in their local currency. The only exceptions are AUDI HUNGARIA

MOTOR Kft. and Audi Volkswagen Middle East FZE, which prepare their annual financial

statements in euros and US dollars respectively, rather than in local currency. The concept

of the “functional currency” is applied when translating financial statements prepared in

foreign currency. Assets and liabilities are translated at the closing rate. The effects of for-

eign currency translation on equity are reported in the currency exchange reserve. The items

in the income statement are translated using weighted average monthly rates. Exchange

differences resulting from the use of diverging exchange rates in the balance sheet and

income statement are recognised in equity with no effect on the income statement.

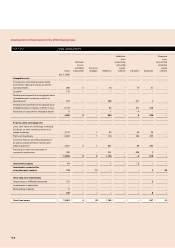

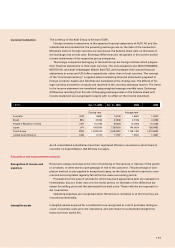

1 EUR= Dec. 31, 2006 Dec. 31, 2005 2006 2005

Closing rate Average rate

Australia AUD 1.6691 1.6109 1.6667 1.6320

Brazil BRL 2.8152 2.7608 2.7336 3.0368

People’s Republic of China CNY 10.2793 9.5204 10.0082 10.2025

Japan JPY 156.9300 138.9000 146.0624 136.8482

South Korea KRW 1,224.8100 1,184.4200 1,198.1480 1,273.6043

United Arab Emirates USD 1.3170 1.1797 1.2557 1.2441

As all consolidated subsidiaries have their registered offices in countries in which there is

currently no hyperinflation, IAS 29 does not apply.

Recognition and measurement principles

Revenue is always recorded at the time of rendering of the services or delivery of the goods

or products, in other words upon passage of risk to the customer. The percentage of com-

pletion method is only applied in exceptional cases, as the dates on which a service is com-

menced and completed regularly fall within the same accounting period.

Proceeds from the sale of vehicles for which buy-back agreements exist are realised not

immediately, but at a linear rate over the rental period, on the basis of the difference be-

tween the selling price and the anticipated buy-back price. These vehicles are reported un-

der inventories.

Operating expenses are recognised when the service is rendered or at the time they are

incurred economically.

Intangible assets acquired for consideration are recognised at cost of purchase, taking ac-

count of ancillary costs and cost reductions, and amortised on a scheduled straight-line

basis over their useful life.

Currency translation

Recognition of income and

expenses

Intangible assets