Audi 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 5 8

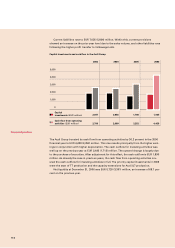

Capital investments

Capital investments scheduled for the medium term are intended predominantly for cus-

tomer-oriented additions to the model and engine range, the essential expansion of devel-

opment and production structures, improving the productivity and quality of process chains,

and strengthening customer loyalty. All investment measures share the same objective of

lastingly strengthening the market position of the Audi Group through a forward-looking

model and brand strategy.

The investment volume for property, plant and equipment and for financial assets envis-

aged for the period from 2007 to 2011, together with development expenditure recognised

as an intangible asset, amounts to just under EUR 13 billion for the Audi Group. The 2007

financial year accounts for around one fifth of this sum. The cash flow from operating activi-

ties will cover investment spending in full for the entire planning period.

Capital investments principally concern direct production activities and will for the most

part be earmarked for the production areas at Ingolstadt, Neckarsulm and Győr. Capital

investments at suppliers represent a further focal area.

Anticipated development in the workforce

The workforce will remain largely unchanged in 2007 compared with the past financial year.

Opportunities for future development

The main determining factors behind the future development of the Audi Group again con-

sist above all in forward-looking strategies and measures designed to assure the steady

qualitative and quantitative growth of the company in the long term.

Systematically pushing forward with the model initiative that is already under way re-

mains of key importance. The large number of new models launched in the past financial

year will be joined by the Audi TT Roadster, the Audi A5 and the new Audi R8 super sports

car in the first half of 2007. Further new models will fit seamlessly into the ongoing process

of extending and rejuvenating the range in the second half of the year and also in subse-

quent years.

The objective of serving existing markets even more successfully remains valid for 2007.

Following the successful establishment of the group’s own subsidiaries in the important

sales regions of the Middle East and South Korea in 2005, the spotlight will shift to the re-

structuring of the sales organisation in North America. The domestic sales organisation also

merits particular attention.

The Audi Group expects the aforementioned measures to provide lasting prospects of

growth that will determine the development of the company’s volume figures as well as its

financial performance data over the coming years.

Over and above the strategy-related determining factors listed above, external factors may

provide additional opportunities. Falls in the price of raw materials and advantageous ex-

change rate movements could, for instance, have a positive impact on financial perform-

ance.