Audi 2006 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

1 8 2

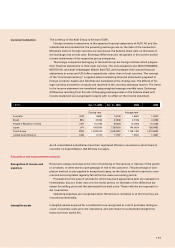

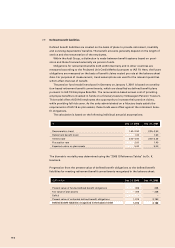

The current taxes in Germany are calculated at the tax rate of 38.3 (38.3) percent. This

represents the sum of the corporate income tax rate of 25.0 percent, the solidarity surcharge

of 5.5 percent and the average trade earnings tax rate for the group. Deferred taxes are like-

wise calculated at a rate of 38.3 percent in the financial year under review, as in the previous

year.

The national income tax rates applicable for foreign companies range from 0 percent to

40 percent.

Due to the current statutory framework in Hungary, the deferred tax assets for AUDI

HUNGARIA MOTOR Kft. for tax relief on capital investments were reduced by EUR 86 million,

as no taxable income is expected until tax exemption expires in 2011. The effects arising as a

result of the tax benefits on research and development expenditure in Hungary are reported

in the reconciliation accounts under tax-exempt income.

There exist loss carryforwards totalling EUR 94 million, of which an amount of EUR 88

million can be used indefinitely. The realisation of tax losses resulted in a reduction of

EUR 20 (15) million in current income tax expense in the 2006 financial year. Deferred tax

assets totalling EUR 88 million were not carried for reasons of impairment. Unused tax loss

carryforwards accounted for EUR 2 million of this amount, and tax rebates for the remaining

EUR 86 million.

Deferred tax totalling EUR – 282 (194) million relates to business transactions reported

directly in equity. One portion amounting to EUR – 109 (123) million relates to defined bene-

fit liabilities and another portion of EUR – 173 (71) million relates to derivative financial in-

struments.

Deferred tax effects of EUR – 8 (–) million resulted from tax-rate changes.