Audi 2006 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 5 6

Report on expected developments

General economic situation

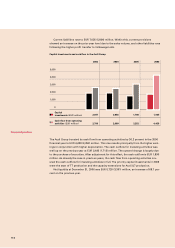

The Audi Group expects the global upswing to continue in 2007 with marginally less vigour.

The incipient slowdown in the US economy in particular will restrict growth worldwide.

South America and Asia will therefore prove to be important centres of growth.

In the USA, economic growth is expected to slow to less than 3.0 percent. On the back of

high energy prices and higher interest rates, private consumption will lose momentum

somewhat. Growth in investment, too, will be weaker than in the previous year due to the

deterioration in the sales and earnings prospects.

There are early indications of an easing of economic growth in the eurozone as a result

of falling global demand and tighter fiscal policy. The Audi Group expects economic growth

of slightly more than 2.0 percent in the eurozone.

In Germany, the economy will cool down again in 2007 following the high growth in

gross domestic product in the previous year. Export activity is likely to be held back by the

continuing strength of the euro and the moderate development of the global economy.

Domestic demand will not provide any lasting stimuli. On the one hand, this is due to private

consumption being dampened by the rise in the VAT rate and other fiscal measures. On the

other hand, investment activity will weaken. The cumulative effect of these factors will be to

reduce economic growth, probably to less than 2.0 percent.

The pace of economic expansion in many emerging countries in South America and Asia

remains high.

Economic growth in China should virtually match the high level of the previous year. As a

result of slightly weaker demand worldwide, the Japanese economy will continue to expand

at the modest rate of around 2.0 percent.

The car industry

Global demand for cars is expected to lose some of its vigour in 2007. For the year as a

whole, the Audi Group expects worldwide unit sales to grow by around 1 percent to 55 mil-

lion vehicles.

Vehicle sales should recover somewhat on the highly competitive US car market, and rise

to 16.8 million units.

By contrast, in Western Europe (excluding Germany) the Audi Group expects the car mar-

ket to be slightly recessive. With vehicle sales forecast to reach 11.1 million, the Western

European car market would be 0.8 percent down on the previous year.

A further overall rise in car sales is expected in Central and Eastern European countries.

In Russia, the most significant market in the region, Audi’s forecast envisages sales growth

to around 1.8 million cars.

The market will remain dynamic in the Asia-Pacific region. However, the pace of growth

in India and China is likely to slow down considerably compared with the previous year. In

China, the Audi Group expects slight growth in the overall market. Japan is expected to

enjoy a positive trend in registrations of new cars.

The registration statistics for the German car market in 2007 will be adversely affected by

the increase in the VAT rate on January 1, 2007. This prompted many customers planning to

buy a new car to bring forward their purchase into 2006. For the market as a whole, the Audi

Group therefore expects to see a slight drop in the volume of cars registered to just under

3.4 million vehicles.

A

nticipated development in

the underlying economic

situation