Audi 2006 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

1 9 2

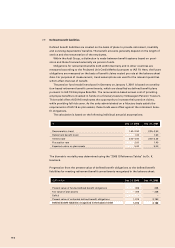

2 9 Defined benefit liabilities

Defined benefit liabilities are created on the basis of plans to provide retirement, invalidity

and surviving dependents’ benefits. The benefit amounts generally depend on the length of

service and the remuneration of the employees.

Within the Audi Group, a distinction is made between benefit systems based on provi-

sions and those financed externally via pension funds.

Obligations for retirement benefits both within Germany and in other countries are

measured according to the Projected Unit Credit Method pursuant to IAS 19. Here, the future

obligations are measured on the basis of benefit claims vested pro rata at the balance sheet

date. For purposes of measurement, trend assumptions are used for the relevant quantities

which affect the level of benefit.

The pension fund model introduced in Germany on January 1, 2001 is based on contribu-

tion-based retirement benefit commitments, which are classified as defined benefit plans

pursuant to IAS 19 (Employee Benefits). The remuneration-based annual cost of providing

employee benefits is invested in funds on a fiduciary basis by Volkswagen Pension Trust e.V.

This model offers AUDI AG employees the opportunity to increase their pension claims,

while providing full risk cover. As the units administrated on a fiduciary basis satisfy the

requirements of IAS 19 as plan assets, these funds were offset against the retirement bene-

fit obligations.

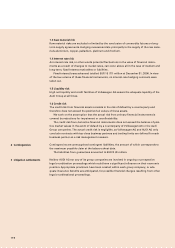

The calculation is based on the following individual actuarial assumptions:

% Dec. 31, 2006 Dec. 31, 2005

Remuneration trend 1.50–3.50 2.25–3.50

Retirement benefit trend 1.00 1.50

Interest rate 2.00–4.50 2.00–4.25

Fluctuation rate 2.00 1.40

Expected return on plan assets 5.00 5.00

The biometric mortality was determined using the “2005 G Reference Tables” by Dr. K.

Heubeck.

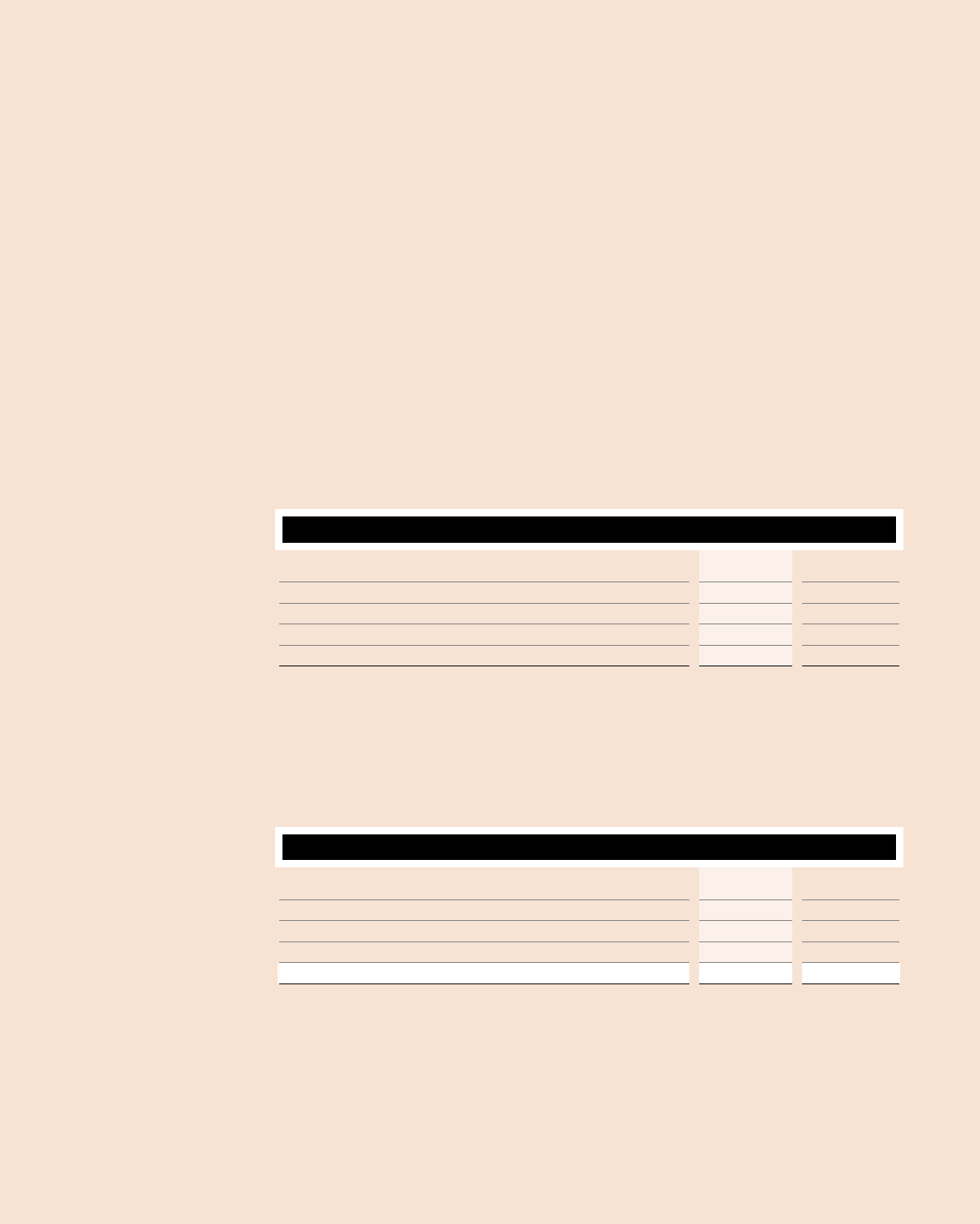

Progression from the present value of defined benefit obligations to the defined benefit

liabilities for meeting retirement benefit commitments recognised in the balance sheet:

EUR million Dec. 31, 2006 Dec. 31, 2005

Present value of funded defined benefit obligations 306 238

Fair value of plan assets – 306 – 238

Deficit – –

Present value of unfunded defined benefit obligations 1,974 2,180

Defined benefit liabilities recognised in the balance sheet 1,974 2,180