Audi 2006 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 7 5

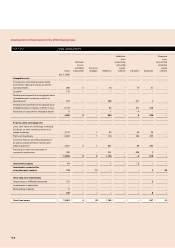

In accordance with IAS 17, property, plant and equipment used on the basis of lease

agreements are recognised in the balance sheet if the conditions of a financial lease are

met, in other words if the significant risks and opportunities which result from their use

have passed to the lessee. Recognition is performed at the time of the agreement, at cost or

at the present value of the minimum lease payments if lower. The straight-line depreciation

method is based on economic life, or on the term of the lease contract if shorter. The pay-

ment obligations resulting from the future lease instalments are recognised as a liability at

the present value of the leasing instalments.

Investment property is measured at amortised cost. Buildings are depreciated on the basis

of a useful life of 33 years.

Companies where AUDI AG is able to exercise significant direct or indirect influence on

financial and operating policy decisions (associates) are accounted for using the equity

method.

Fixed assets are tested regularly for impairment at the balance sheet date. To test for im-

pairment, cash flows anticipated in the future are discounted at rates of between 9.0 and 9.8

percent.

Impairment loss pursuant to IAS 36 is recognised where the recoverable amount from

the use of the asset in question has fallen below its carrying amount.

Within the Audi Group, the value in use of the cash-generating unit in question, deter-

mined according to the entity method, is used in the annual assessment of goodwill im-

pairment. The planning data is compiled on the basis of available knowledge and is influ-

enced by the prevailing macroeconomic developments, as well as by past developments.

The planning period extends over five years, with plausible assumptions on future develop-

ments made for subsequent years.

If the reasons for impairment performed in previous years cease to apply, the impairment

loss is reversed. Goodwill impairment, however, remains unchanged pursuant to IAS 36.

IAS 39 subdivides financial assets (financial instruments) into the following categories:

– financial assets at fair value through profit or loss,

– loans and receivables,

– held-to-maturity investments,

– available-for-sale financial assets.

Financial liabilities are divided into the following categories:

– financial liabilities at fair value through profit or loss,

– financial liabilities measured at amortised cost.

The classification depends on the respective purpose for which a financial asset has

been acquired, and is reassessed at each balance sheet date. No financial instruments in the

category of “held-to-maturity investments” are in use within the Audi Group.

Financial assets include both primary instruments and derivative instruments. Derivative

financial instruments are used as a hedge for items on the balance sheet and for future cash

flows.

Where financial instruments are purchased or sold in the customary manner, they are

recognised using settlement date accounting, in other words at the value on the day on

which the asset is delivered.

Investment property

Investments accounted for

using the equity method

Impairment tests

Financial assets