Audi 2006 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2006 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 7 1

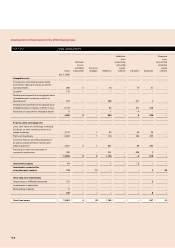

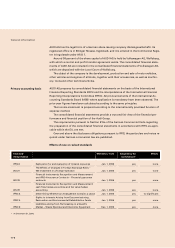

New or revised standards not applied

Standard/

Interpretation

Mandatory from Adopted by EU

Commission*

Anticipated

effects

IFRS 7 Financial Instruments: Disclosures Jan. 1, 2006 yes notes

IFRS 8 Operating Segments Jan. 1, 2009 no

segment

reporting

IAS 1

Presentation of Financial Statements – particulars of

capital Jan. 1, 2007 yes notes

IFRIC 7

Applying the Restatement Approach under IAS 29

Financial Reporting in Hyperinflationary Economies Mar. 1, 2006 yes none

IFRIC 8 Scope of IFRS 2 May 1, 2006 yes none

IFRIC 9 Reassessment of Embedded Derivatives Jun. 1, 2006 yes no significant

IFRIC 10 Interim Financial Reporting and Impairment Nov. 1, 2006 no not foreseeable

IFRIC 11 IFRS 2: Group and Treasury Share Transactions Mar. 1, 2007 no none

IFRIC 12 Service Concession Arrangements Jan. 1, 2008 no none

* At December 31, 2006.

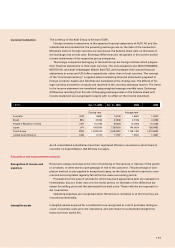

Presentation of anticipated return on plan assets pursuant to IAS 19

From the 2006 financial year, the anticipated return on plan assets is presented in the finan-

cial result, for ease of comparison. For the 2005 financial year, the anticipated return on plan

assets (EUR 11 million) recognised in the functional areas were reclassified under the finan-

cial result.

In addition to AUDI AG, the consolidated financial statements include all principal compa-

nies where AUDI AG directly or indirectly has scope for determining the financial and busi-

ness policy in such a way that other group companies benefit from the activities of the

companies in question (subsidiaries). Consolidation begins at that point in time from which

it acquires the opportunity for control; it ends when that opportunity ceases to be available.

Companies where AUDI AG is able to exercise significant direct or indirect influence on

financial and operating policy decisions (“associates”) are accounted for using the equity

method.

The following changes to the consolidated companies occurred in the past financial year:

the fully consolidated companies Audi Synko GmbH and Audi Zentrum Hannover GmbH, as

well as Audi Zentrum Stuttgart GmbH & Co. KG, which was accounted for using the equity

method, have been withdrawn from the group.

Subsidiaries excluded from consolidation and participating interests are always reported

at their cost of purchase, as no active market exists for the shares of these companies and

no fair value can reliably be determined with a justifiable amount of effort. These subsidiar-

ies are substantially dormant companies or companies with only limited business opera-

tions.

The Group