Air New Zealand 2016 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Statement of Accounting Policies

For the year to 30 June 2016

7

AIR NEW ZEALAND GROUPAIR NEW ZEALAND GROUP

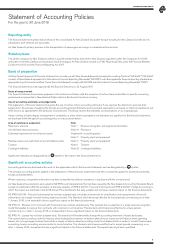

Reporting entity

The financial statements presented are those of the consolidated Air New Zealand Group (the Group), including Air New Zealand Limited and its

subsidiaries, joint ventures and associates.

Air New Zealand’s primary business is the transportation of passengers and cargo on scheduled airline services.

Statutory base

The parent company, Air New Zealand Limited, is a profit-oriented entity, domiciled in New Zealand, registered under the Companies Act 1993

and listed on the New Zealand and Australian Stock Exchanges. Air New Zealand Limited is a FMC Reporting Entity under the Financial Markets

Conduct Act 2013 and the Financial Reporting Act 2013.

Basis of preparation

Air New Zealand prepares its financial statements in accordance with New Zealand Generally Accepted Accounting Practice (“NZ GAAP”). NZ GAAP

consists of New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other applicable financial reporting standards as

appropriate to profit-oriented entities. These financial statements comply with NZ IFRS and International Financial Reporting Standards (“IFRS”).

The financial statements were approved by the Board of Directors on 26 August 2016.

Basis of measurement

The financial statements have been prepared on the historical cost basis, with the exception of certain items as identified in specific accounting

policies and are presented in New Zealand Dollars which is the Group’s functional currency.

Use of accounting estimates and judgements

The preparation of financial statements requires the use of certain critical accounting estimates. It also requires the directors to exercise their

judgement in the process of applying the Group’s accounting policies. Estimates and associated assumptions are based on historical experience and

other factors, as appropriate to the particular circumstances. The Group reviews the estimates and assumptions on an ongoing basis.

Areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements

are disclosed within the specific accounting policy or note as shown below:

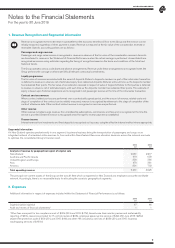

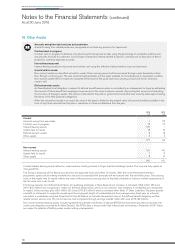

Area of estimate or judgement Note

Revenue in advance Note 1 Revenue recognition and segmental information

Aircraft lease return provisions Note 16 Provisions

Estimated impairment of non-financial assets ‘Impairment’ accounting policy

Note 11 Property, plant and equipment

Residual values and useful lives of aircraft related assets Note 11 Property, plant and equipment

Taxation Note 4 Taxation

Contingent liabilities Note 23 Contingent liabilities

Significant estimates are designated by an symbol in the notes to the financial statements.

Significant accounting policies

Accounting policies are disclosed within each of the applicable notes to the financial statements and are designated by a symbol.

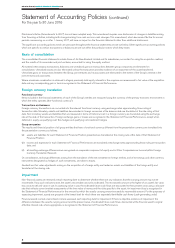

The principal accounting policies applied in the preparation of these financial statements have been consistently applied to all periods presented,

except as detailed below.

Where necessary, comparative information has been reclassified to achieve consistency in disclosure with the current period.

Air New Zealand has elected to early adopt all NZ IFRSs and Interpretations that had been issued by the New Zealand Accounting Standards Board,

except as noted below. With the exception of the early adoption of IFRS 9 (2010) - Financial Instruments and IFRS 9 (2013) - Hedge Accounting for

which the impact was disclosed in the 2015 Annual Financial Results, the early adoption did not have a material impact on the financial statements.

NZ IFRS 9 (2014) - Financial Instruments has not been adopted early. It includes a framework for classification and measurement of financial

instruments and a single, forward-looking impairment model. This Standard, which becomes effective for annual periods commencing on or after

1 January 2018, is not expected to have a significant impact on the financial statements.

NZ IFRS 15 - Revenue from Contracts with Customers has not been adopted early. This standard has an objective of a single revenue recognition

model that applies to revenue from contracts with customers in all industries. This standard, which becomes effective for annual periods

commencing on or after 1 January 2018, is not expected to have a significant impact on the financial statements.

NZ IFRS 16 - Leases has not been adopted early. This standard will fundamentally change the accounting treatment of leases by lessees.

The current dual accounting model for lessees, which distinguishes between on balance sheet finance leases and off balance sheet operating

leases, will no longer apply. Instead, there will be a single, on balance sheet accounting model for all leases which is similar to current finance lease

accounting. Lessor accounting remains similar to current practice. This standard, which becomes effective for annual periods commencing on or

after 1 January 2019, is expected to have a significant impact on the financial statements. The impact has not yet been quantified.