Air New Zealand 2016 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

13

AIR NEW ZEALAND GROUPAIR NEW ZEALAND GROUP

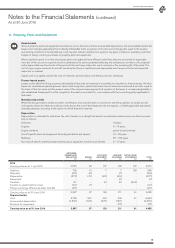

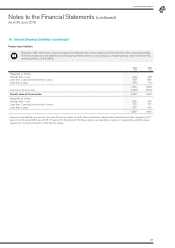

8. Inventories

Inventories are measured at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO)

cost method. Net realisable value is the estimated selling price in the ordinary course of business, less applicable variable

selling expenses.

2016

$M

2015

$M

Engineering expendables

Consumable stores

86

17

107

13

103 120

Held at cost

Held initially at cost

Less provision for inventory obsolescence

84

75

(56)

88

82

(50)

Held at net realisable value 19 32

103 120

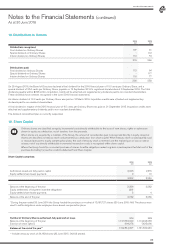

9. Investment in Quoted Equity Instruments

Investments in quoted equity instruments are stated at fair value. Changes in the fair value of the investment in quoted equity

instruments, including any related foreign exchange component, are recognised through profit or loss unless an irrevocable

election has been made at inception to recognise these through other comprehensive income.

2016

$M

2015

$M

Investment in Virgin Australia Holdings Limited:

Current

Balance at the beginning of the year

Transfer from investments in associates

Fair value changes recognised in profit or loss

Disposals

-

382

(79)

(281)

-

-

-

-

Balance at the end of the year 22 -

Further details of the Group’s investment in Virgin Australia are contained within Note 3.

The investment has been classified as a current asset as it is the Group’s intention to dispose of the investment within the next 12 months.

On 4 August 2016 the Group participated in a Virgin Australia 1 for 1 pro-rata rights issue and acquired an additional 102,889,330 shares for

A$0.21 per share. Following the rights issue the Group’s interest in Virgin Australia was retained at 2.5%.

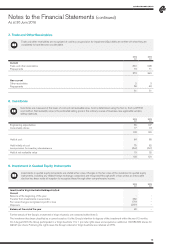

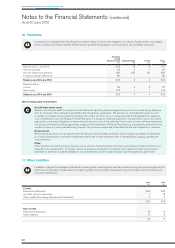

7. Trade and Other Receivables

Trade and other receivables are recognised at cost less any provision for impairment. Bad debts are written-off when they are

considered to have become uncollectable.

2016

$M

2015

$M

Current

Trade and other receivables

Prepayments

300

73

298

71

373 369

Non-current

Other receivables

Prepayments

2

59

3

48

61 51